Whether you’re an experienced dividend stock investor or buying stocks for the first time, you’ve probably struggled to figure out how your portfolio is performing.

You may have a sense about your returns, and you can see the dividends your earning, but how does it all translate to an overall rate of return?

To properly measure your portfolio’s performance you need an advanced portfolio analysis tool like Snowball Analytics, which brings professional portfolio measurement capabilities to retail investors. We explore the platform in detail in this Snowball Analytics review.

Promo: Save 30% of all Snowball Analytics subscriptions from November 25 to December 4, 2024.

Quick Summary

- Track and analyze your investments with a single tool.

- Intuitive dashboard summarizes key performance metrics for investors

- Detailed stock tracker for all the ticker symbols in your portfolio

- Track a range of assets including stocks, ETFs, mutual funds, commodities, crypto, rental income, and more.

Snowball Analytics Details | |

|---|---|

Product Name | Investment portfolio analytics |

Price | $0 - $299.99/month |

Free plan | Yes |

Promotions | 30% Off |

What Is Snowball Analytics?

Snowball Analytics is a portfolio analysis tool that measures your portfolio's performance. It also tracks key metrics such as dividend yield and risk-adjusted returns. Snowball Analytics can import spreadsheets from your brokerage account, or import data automatically from thousands of brokerages.

While Snowball Analytics can track a wide range of investments (including several alternative investments), the platform provides specialized insight for individual stock investors, including dividend investors. The site isn’t a simple portfolio tracker designed for personal finance aficionados. It's much closer to a Bloomberg terminal for retail investors. Snowball Analytics isn’t for everyone, but if you're looking for in depth data, it’s a tool you should consider.

What Does It Offer?

Snowball Analytics is a portfolio analysis platform designed to give everyday investors the same access to information that professional investors have. Here are some of the standout features.

Investment Categories

When you join Snowball Analytics, you'll be prompted to arrange your investments into investment categories. The categories are customizable, so you can choose sectors, investment strategies, or even high-level categories like stocks, REITs, commodities, and more.

The investment categories enable users to view their portfolio in the way they prefer. While setting up the investment categories can take some time, it’s one of the key features of Snowball Analytics. After all, asset allocation is key to successful investing, and a customized view of your asset allocation is one of the primary benefits of Snowball Analytics.

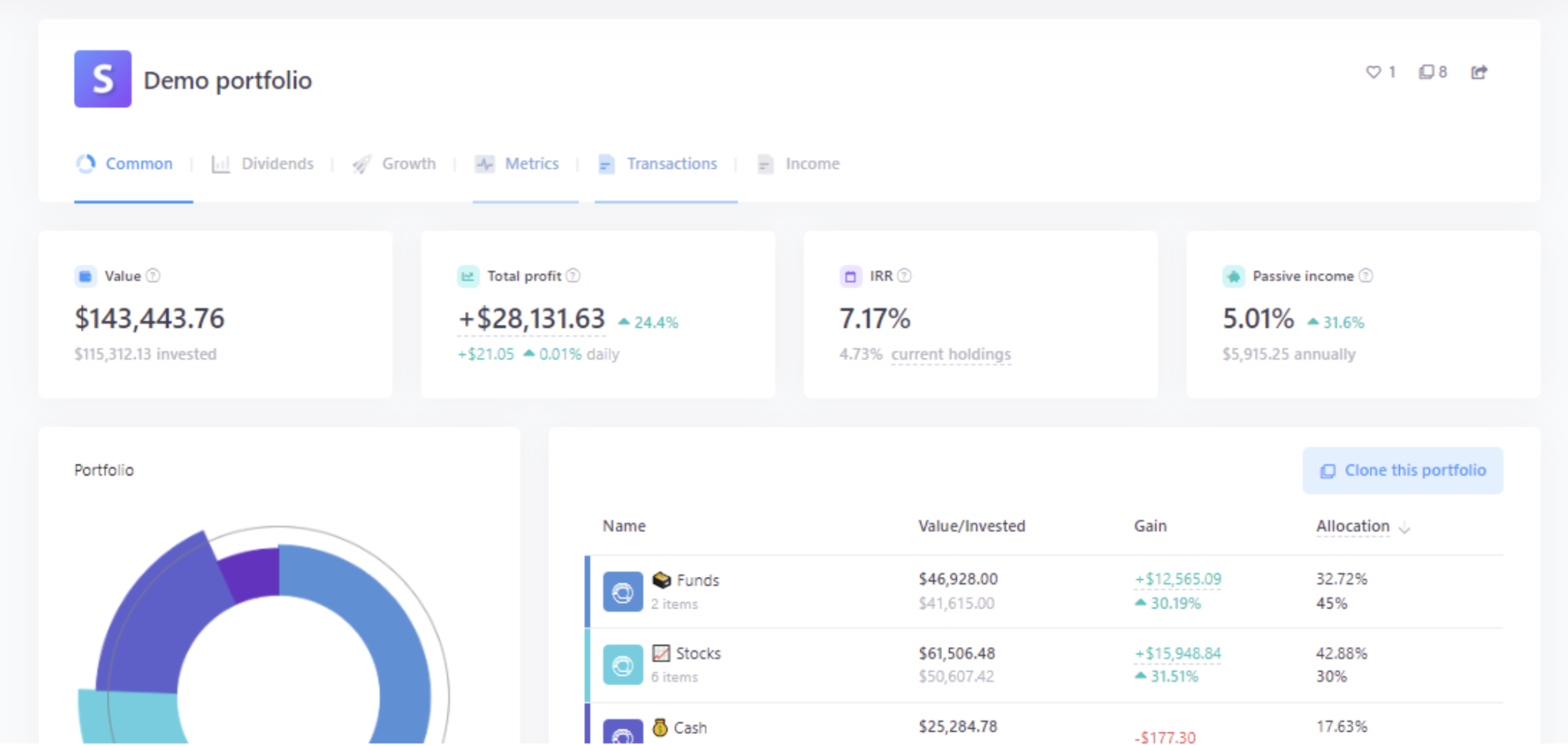

Dashboard With Performance Metrics

Snowball Analytics dashboard displays your portfolio’s value, profitability, internal rate of return, and its annualized passive income as a percent of the value. In addition, investors can dig into their dividend and growth strategies (including comparing different benchmarks), and look at risk-adjusted returns in the metrics section.

Screenshot of Snowball Analytics Portfolio

Dividend Calendar

The dividend calendar forecasts income for the year based on an investor’s current portfolio allocation. Different companies pay their dividends at different times of the year, so it’s helpful for investors to get a feel for their annualized income, and when they can expect to receive it. This is especially helpful if you plan to use dividends as part of your passive income strategy.

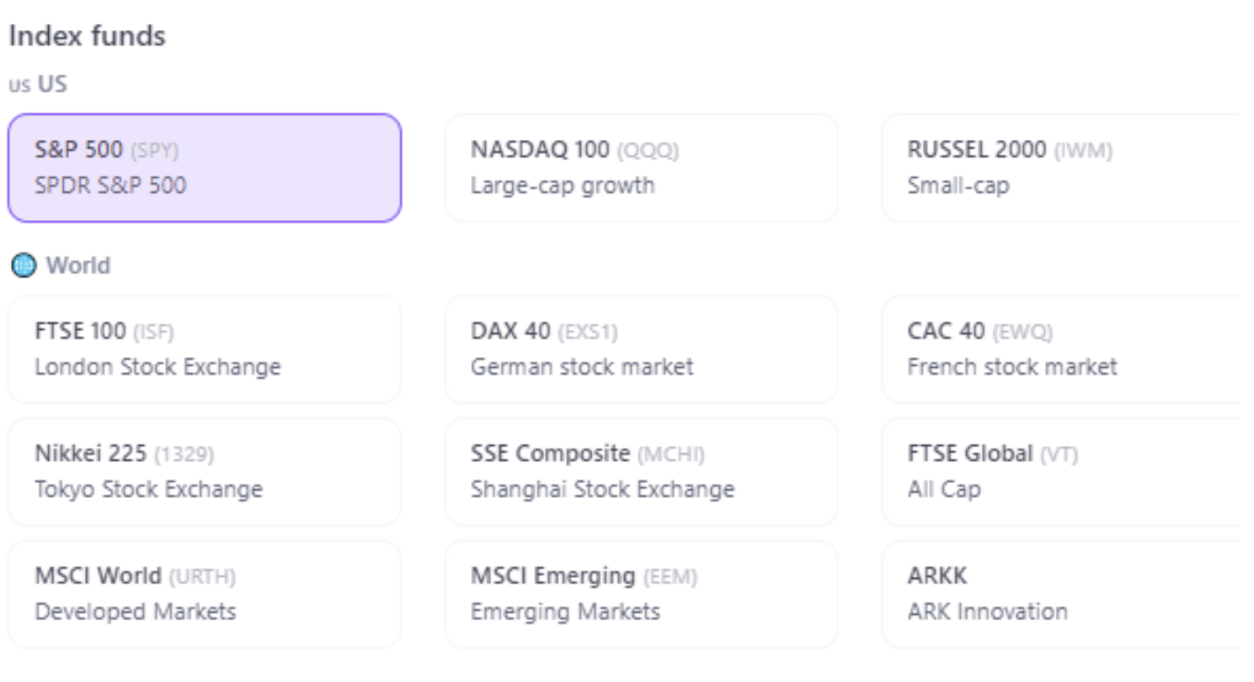

Benchmarking Metrics

One of Snowball Analytics' standout features is the access to multiple benchmarks. Most portfolio analysis tools neglect benchmarks and those that offer a benchmark typically compare a portfolio’s performance to the S&P 500. Even the free version offers a dozen benchmarks, and you can upgrade to compare your portfolio to hundreds of benchmarks.

Screenshot of Snowball Analytics Benchmarks.

Rebalancing Tools

Maintaining your asset allocation across multiple accounts is a huge challenge even if you’re an index fund investor. But rebalancing when you have retirement accounts and brokerages and a mix of funds and stocks is a nightmare. Thankfully, Snowball Analytics offers guidance on how investors can best balance their portfolio with new contributions or if they are doing annual rebalancing. The advanced rebalancing considers multiple factors including the investment category, tax-loss harvesting, and more.

Are There Any Fees?

Snowball Analytics offers a free version of the platform, but the free version requires users to import data using spreadsheets from their brokers. Typically, this will only be appropriate for investors with a limited number of accounts (perhaps a Roth IRA and a workplace 401(k)), and those with relatively simple portfolios. It also only allows 10 holdings which is okay for an index fund investor, but not ideal for single stock investors.

These are the paid versions of the platform:

Starter | Investor | Professional | |

|---|---|---|---|

Price | $5.59/month or $55.99/year | $10.49/month or $104.99/year | $299.99/month + |

Best For | Most individual stock investors | Advanced investors with an interest in portfolio backtesting | Professional investors managing money for multiple people |

Additional Features | Link to brokerages, unlimited holdings, advanced rebalance tool, dividend rating, two watchlists, and more | Up to 10 portfolios, 10 watchlists, unlimited benchmarking, 10 years of company fundamentals, portfolio backtesting | Unlimited portfolios, priority support |

How Does Snowball Analytics Compare?

Snowball Analytics is a solid platform for individual stock investors. It keeps investors focused on the most important metrics including profitability, risk-adjusted returns, income (dividends), and returns relative to benchmarks. Very few portfolio-tracking tools give this type of detail to everyday investors.

Portfolio Visualizer is a better tool for investors who are trying to figure out their investment strategy (and who want to do portfolio backtesting), and Empower is better suited to hands-off index investors. But if you’re committed to individual stock investing, then Snowball Analytics offers a powerful tool at a reasonable price.

It’s a platform that many investors could use regularly (a few times per quarter) for a decade or more because the metrics it tracks are customized to your portfolio. Plus, the metrics it displays are key performance indicators that have a proven track record for data-driven investors.

Header |  | ||

|---|---|---|---|

Rating | |||

Pricing | $0-$299.99/month | $0-$55/month | Free Dashboard & Net Worth Tracking |

Free Plan? | |||

Brokerage Service | |||

Cell |

How Do I Open A Snowball Analytics Account?

Signing up for a Snowball Analytics account doesn’t take long. Navigate to the Start For Free page and enter your email address and password. Since Snowball Analytics isn’t a brokerage, you don’t have to provide any personal details to get started.

Once you have an account, you will need to upload spreadsheets from your brokerage or connect to your brokerage account using a third-party integrator. The tool will give you access to the full range of functionality for 14 days. After that, you need to enter your credit card information to continue to use the paid features.

Is It Safe And Secure?

Snowball Analytics uses best-in-class security practices to keep user information safe. The personal data it stores is encrypted both in transit and at rest to keep it as safe as possible. It collects payment using a secure and well-regarded third party. Finally, it never collects your brokerage passwords or log in credentials. Rather it uses a third-party integrator to protect your data.

While these protections cannot guarantee that your information is perfectly safe online, they go a long way toward keeping your sensitive personal information safe and secure.

Also, Snowball Analytics is based in the European Union, so it follows GDPR privacy laws. This means that they won't sell your personal information without your consent, and you have the right to opt out of any marketing campaign.

Contact

While Snowball Analytics supports investors inside and outside the United States, the company is headquartered in France.

For most U.S.-based investors, the best way to get in touch with Snowball Analytics is by emailing support@snowball-analytics.com. The company’s headquarters is located at Le Forum 27 Rue Maurice Flandin, Lyon Cedex, 3, 69444 France.

Is It Worth It?

Passive index investors won’t see much value from Snowball Analytics, and short-term traders won’t get the information they need from the platform. But if you’re a long-term individual stock investor, Snowball Analytics can add a lot of value, as it will keep you focused on the data and not your feelings. It offers long-run perspectives while giving you present readings on your portfolio’s profitability, risk-adjusted returns, and other key metrics.

Features

Product | Portfolio Analysis Tools |

Free Plan | Yes |

Paid Plans | $5.59-$299.99/month |

Available Tools |

|

Customer Service Email | support@snowball-analytics.com |

Promotions | 30% Off For Black Friday and Cyber Week |

Snowball Analytics Review

-

Pricing and Fees

-

Ease of Use

-

Tools and Features

-

Products and Services

-

Customer Service

Overall

Summary

Snowball Analytics offers investment tracking and portfolio analysis software for individual stock investors, including dividend investors.

Pros

- Keeps investors focused on the right metrics

- Offers present and historical metrics

- A fourteen-day free trial can help you decide whether the tool is for you.

- High level of security within the tool.

Cons

- The free tool has limited value

- Setting up investment categories can be time-consuming

- Not suitable for short-term traders.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Colin Graves Reviewed by: Robert Farrington