Pocketsmith is a popular budgeting app that also helps you plan for the future and make more informed financial choices.

Its built-in visualization tools can help you get a better handle on your money habits.

But with a limited free plan, and pricing that runs as high as $39.95 per month, how does Pocketsmith compare to other budgeting apps, like YNAB and Copilot? We explore what PocketSmith has to offer so you can decide if it’s a good fit for your wallet.

Promo: Right now you can get 30% off on all annual plans through December 2, 2024.

Pocketsmith | |

|---|---|

Product Name | Pocketsmith |

Pricing |

|

Automatic Bank Feeds? | Yes |

Multi-currency Support? | Yes |

Promotions | 30% Off |

What Is PocketSmith?

New-Zealand-based PocketSmith is a personal finance app designed to not only help you create a budget and track your spending, but also plan for the future.

In addition to the standard features you expect from a budgeting app, PocketSmith comes equipped with advanced multi-currency support, with live bank feeds for 49 countries. It also offers powerful forecasting tools, allowing you to create what-if-scenarios and make cash projections up to 30 years into the future.

What Does It Offer?

Here's a closer look at Pocketsmith's main features.

Automated Data Collection

PocketSmith allows you to automatically import your transactions. Since the platform is compatible with over 14,000 financial institutions, you shouldn’t have a problem getting your transactions into the system seamlessly.

While PocketSmith can categorize all of your transactions on its own, you’ll also have the option to set up rules of your own. For example, you have the ability to push all transactions from a particular store out of the grocery category and into the entertainment category.

Personalized Budgeting

Pocketsmith can help you fine-tune a personalized budget, allowing you to break down your budget in a timeframe that works for you. For example, you can plan your spending over a two-week span, a full month, or several months.

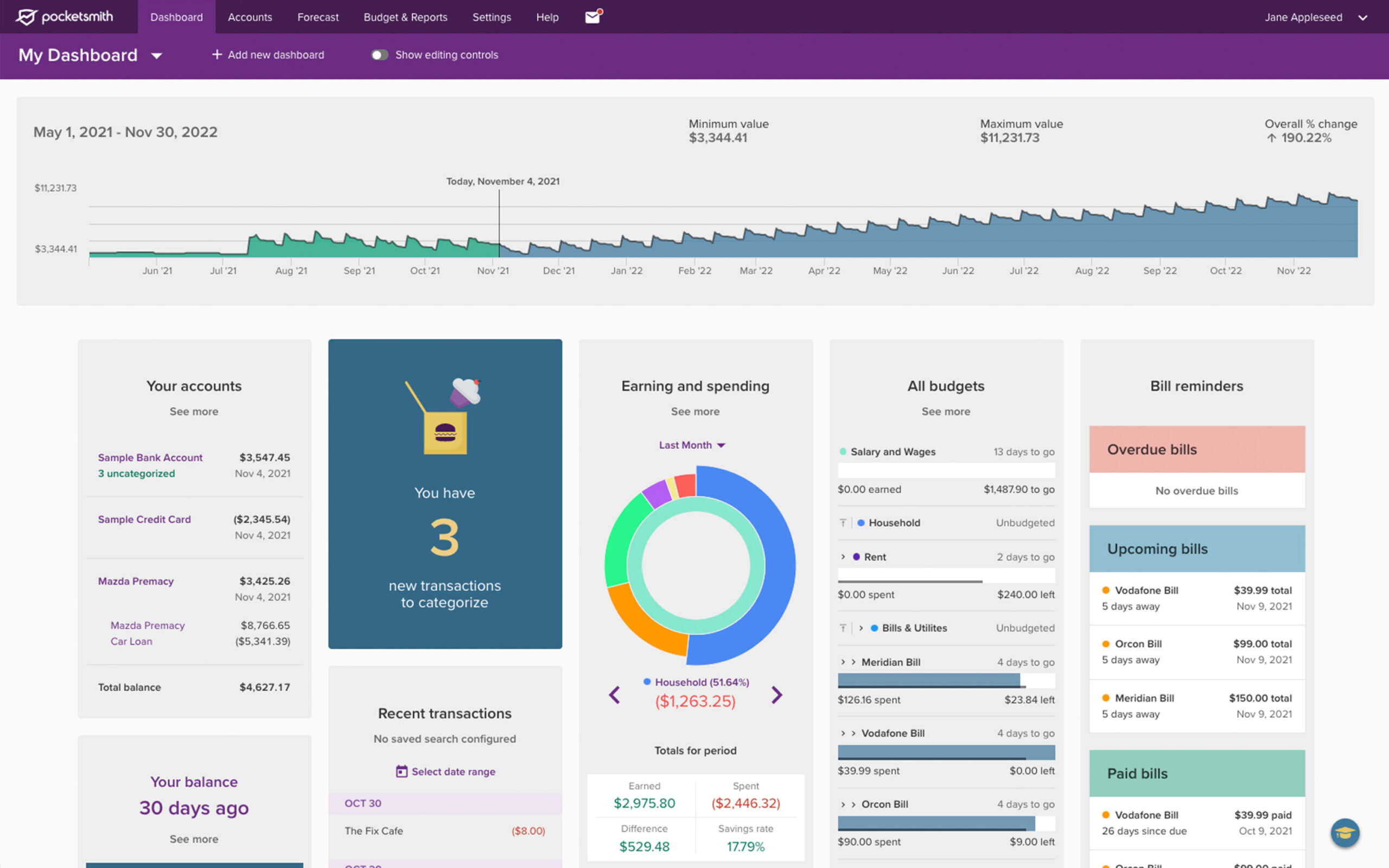

As you use the tool, you can tap into the visual reports and dashboards to monitor your progress.

Financial Forecasting

PocketSmith allows you to forecast how your current financial choices will impact your financial future. You can visualize your financial future with graphs, calendars, and cash flow views for different financial scenarios. Not only can you see how your current money behavior will shake out, you can also see how different choices could impact your future net worth.

Multi-Currency Support

PocketSmith can help you track your finances in multiple currencies. After you set a native currency, the platform will automatically convert your assets and liabilities into a single net worth in you base currency. But you’ll still be able to monitor other accounts in their own currencies.

For example, you might set your base currency in US dollars. But if you have a bank account that holds Euros, you can monitor that balance in Euros. And PocketSmith will convert the value of that account to USD and include it in your overall net worth.

Customized Dashboard With Detailed Information

PocketSmith offers detailed information about your financial situation. For example, you can see how much you have remaining each budgeting category, which can help you avoid overspending. Other details include bill reminders and how many days are left in your budget.

But while these details can be helpful, it’s easy to get overwhelmed. The good news is that you can customize the dashboard to highlight the information you care about and place it front and center.

Are There Any Fees?

PocketSmith offers both a free version and paid tiers. The free version is very limited, and doesn’t even offer automatic bank feeds. This means you'd hav to be comfortable with manually entering your information if you want to use the free version of the platform.

The paid options are broken down into three plans: Foundation, Flourish, and Fortune.

Foundation: $14.95/month or $119 yearly

The Foundation tier should satisfy anyone looking for a basic budgeting tool that supports automatic bank feeds with some limited forecasting tools. You can connect 6 banks from 1 country, and create unlimited accounts and budgets.

Flourish: $24.95/month or $199 yearly

Flourish is Pocketsmith's mid-tier plan. I let's you add 18 banks from all countries, and make cash projections out 30 years. You can also create 18 dashboards.

Fortune: $39.95/month or $319 yearly

Fortune is Pocketsmith's most capable tier, but also its most expensive. If you need extensive multi-currency support, this is the plan for you. With Fortune, you can connect unlimited banks from all countries, create unlimited dashboards, and make cash projections out 60 years. You can also access priority customer support.

How Does PocketSmith Compare?

PocketSmith is a robust financial management app. But it’s not the only option out there. Here’s how it stacks up.

YNAB, or You Need A Budget, is a comprehensive budgeting tool that automatically tracks and categorizes your expenses. It follows a zero-based approach to budgeting, and assigns every dollar a job so that you can make progress towards your financial goals. At a cost of $99 per year, the YNAB is a more affordable option than PocketSmith.

That said, YNAB relies on a third-party service, called Multi-Currency for YNAB, to create a single budget from multiple currencies. If you want to track accounts in several countries, Pocketsmith is probably the better option.

Copilot is yet another well-rounded app that helps you track your spending, monitor your budget, review your investments, and build your credit. The platform offers helpful visualizations to make handling your finances easier. In terms of price, it’s more on par with YNAB at $95 per year.

| |||

|---|---|---|---|

Rating | |||

Pricing | Free to $39.99/month | $14.99 per month or $99 per year | $13 per month or $95 per year |

Free Trial? | Free tier available | 34 days | 2 month free trial with promo code TCI2024 |

Platform | iOS, Android, Web | iOS, Android, Web, Alexa, and more | iOS, Android, Web |

Cell |

How Do I Open An Account?

If you want to open a Pocketsmith account, start by picking your service plan. From there, you’ll be asked to provide a username, email address, and password.

And, of course, you’ll need to provide your credit card information. Once you create the account, you can begin linking your financial accounts and start making the most of the platform.

Is It Safe And Secure?

PocketSmith takes your privacy very seriously. While your data is in transit and at rest, it is fully-encrypted. Also, all Pocketsmith plans offer the ability to add two-factor authentication as a way to further protect your information.

How Do I Contact PocketSmith?

You can get in touch with PocketSmith by emailing help@pocketsmith.com.

Pocketsmith Customer Service

The app has earned 3.3 out of 5 stars in the Apple App Store and 3.4 out of 5 stars in the Google Play Store. Also, the few people who have reviewed it on Trustpilot give it 2.6 out of 5 stars. The mediocre reviews might not bode well for a smooth experience as a customer.

Is It Worth It?

PocketSmith seems like an amazing piece of technology, but the steep price tag may give some pause. Unless you can get by with the manual entry of its free plan, simpler tools seem to hover in the $5-7 per month range.

That said, some people will love Pocketsmith's visualization tools, and for them the $9.99 monthly price tag may prove worthwhile.

If PocketSmith isn’t the right fit, consider one of our top budgeting apps.

Price |

|

Budgeting | Yes |

Income Tracking | Yes |

Expense Tracking | Yes |

Automatic Bank Feeds | Yes |

Net Worth Tracking | Yes |

Cash Forecasts | Yes, up to 60 years |

Multi-Currency Support | Yes |

Number of Countries | Up to 49 |

Customer Service Number | N/A |

Customer Service Email | help@pocketsmith.com |

Mobile App Availability | iOS and Android |

Promotions | 30% Off Annual Plans |

Pocketsmith Review

-

Features

-

Ease Of Use

-

Level Of Detail

-

Pricing

Overall

Summary

PocketSmith is a financial management app that supports multiple currencies and uses forecasting to help change your spending behavior.

Pros

- Worthwhile visualizations to help you manage money

- Automated transaction categorization

- Forecasting tools to see future financial situation

Cons

- High price tag

- Free version requires you to manually enter your data

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Colin Graves Reviewed by: Robert Farrington