Finding a bank that offers accounts with reasonable APYs and minimal fees can be like finding a needle in a haystack.

If you have been searching for that perfect combination, Continental Bank might just be the right match for you. The competitive interest rates make it worthwhile to take a look at this Utah-based bank.

Let’s take a closer look at Continental Bank. Then you can decide if it's the right fit for your banking needs.

Continental Bank Details | |

|---|---|

Product Name | Continental Bank High Yield Savings Account |

Min Deposit | $1 |

Monthly Fee | None |

Interest Rate | 4.41% |

Promotions | None |

What Is Continental Bank?

Continental Bank was established in 2003 in Salt Lake City, Utah. Since its founding, the bank has built a reputation for providing commercial banking services.

According to the bank, “we specialize in commercial equipment financing for small and medium-sized businesses nationwide and are known both for our willingness to listen to our customers’ needs, and ability to fund their deals quickly.”

But more recently, it has expanded its offerings to serve individual banking needs. And it's making a splash with competitive interest rates and low fees.

What Does It Offer?

Continental Bank puts a focus on its commercial banking options. But its expansion into personal banking makes it worth taking a closer look for savers across the nation. Here’s what you’ll find through this bank.

Commercial Banking

Continental Bank places a focus on providing equipment finance. Specifically, it focuses on these industries:

- Construction

- Commercial Trucking

- Healthcare

- Printing

- Manufacturing and Machine Tools

- Materials Handling

But its commercial financing doesn’t stop there. The bank is also an SBA Preferred Lender of 7(a) and 504 loans. Plus, it can offer real estate financing lines of credit.

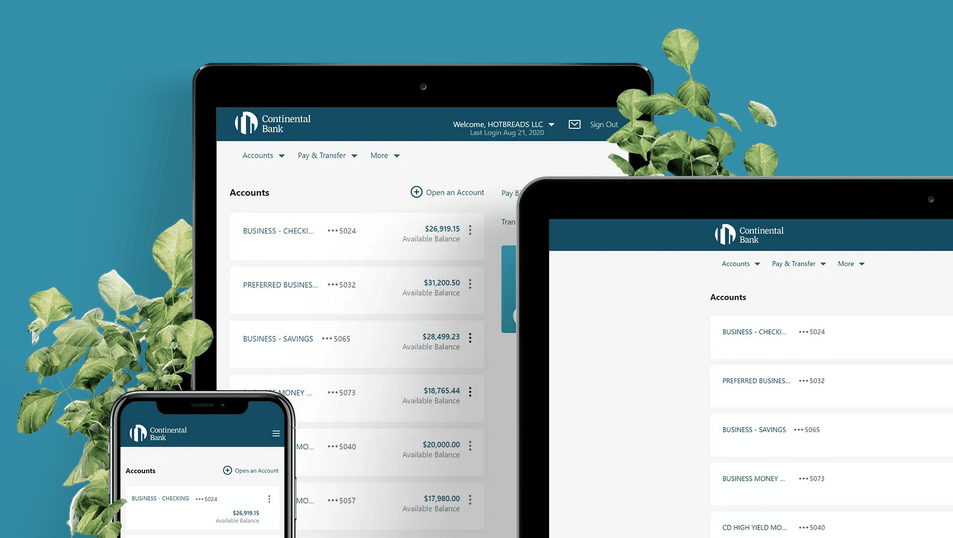

Business Checking Account

Another offering on the commercial side is the collection of business checking accounts. You’ll find three options -- basic business checking, preferred business checking, and performance business checking.

The basic business checking doesn't have a monthly maintenance fee and covers up to 75 monthly transactions for free. But you’ll miss out on earning interest on your balance.

If you spring for the preferred or performance checking account, you’ll receive a 0.15% APY and 0.25% APY, respectively.

Business Savings Products

In addition to business checking accounts, this bank offers several business savings options. These include:

- The basic business savings comes with a 0.25% APY

- The preferred business savings comes with a 0.35% APY

- The business money market account comes with a 0.30% APY

Each of these savings products can help your money grow.

High Yield Savings Account

More recently, Continental Bank has launched a personal high yield savings account. The APY on this account is 4.41%. That’s very competitive in our low interest rate environment.

The downside of this account is the only way to move money is through a linked account. You won’t have the option to set up direct deposits or deposit cash.

If you are looking for a simple account to tuck away your savings, this could be the right fit. Want to give it a try? Sign up today.

Certificates Of Deposit (CDs)

A final offering to cover is the CDs available to individuals through Continental Bank. Here are the rates:

- 3 Month CD: 0.55% APY

- 13 Month CD: 0.90% APY

If you want to grow your savings in a low risk way, a CD is a great option. Here’s where you can sign up for these CDs.

Are There Any Fees?

Each of the business checking accounts comes with a monthly fee. The preferred business checking account has a $25 monthly fee that you can avoid with a $10,000 average daily balance. And the performance checking account has a $65 monthly fee that you can avoid with a $50,000 average daily balance.

With the basic business savings account, you’ll face a $3 monthly fee if you don’t maintain a minimum average balance of $500. The preferred saving account has a $10 monthly fee that can be avoided with a $20,000 minimum average daily balance. The money market account has a $20 monthly fee that you can avoid with a $5,000 minimum daily balance.

How Does Continental Bank Compare?

Continental Bank isn’t the only option if you are looking for a high yield savings account with minimal fees.

For example, you could open a high yield savings account with Discover that offers a 3.90% APY. Or you could work with CIT Bank, which offers a money market account at 1.55% APY.

Want to see all of your options? Check out our full list of favorite high yield savings accounts.

Header |  | ||

|---|---|---|---|

Rating | |||

Savings APY | 4.41% | 1.55% | 3.90% |

Interest-Earning Checking | |||

FDIC Insured | |||

Cell |

How Do I Open An Account?

Ready to work with Continental Bank?

Here’s where to start the sign up process.

Once you select the account you want to open, you’ll need to provide an email address and password to get started. Additionally, be prepared to provide your address, date of birth, and Social Security Number.

Keep in mind you’ll need to make a minimum opening deposit of $1. So have your current bank details ready.

Is It Safe And Secure?

Continental Bank offers FDIC-insured accounts. With that, your deposits of up to $250,000 are insured. Although you’ll sign up through SaveBetter, there are safeguards in place to protect your information.

How Do I Contact Continental Bank?

Whether or not you decide to work with Continental Bank, there are a few ways to get in contact. You can fill out their website contact form, call 801-595-7000 or email customerservice@cbankus.com.

Plus, you can head to their lobby hours from 9 AM to 5 PM at 15 W South Temple Suit 3000 in Salt Lake City, Utah.

Is It Worth It?

The relatively high APY offered by Continental Bank makes their high yield savings account worth considering. Additionally, the extensive commercial lending experience could come in handy if you have equipment financing needs.

But Continental Bank isn’t the only option. Don’t forget to explore other accounts to see which is the best match for your financial goals.

Continental Bank Features

Account Types |

|

Minimum Deposit | $1 |

APY | 4.41% APY on Savings |

Maintenance Fees | $0 |

Overdraft Fee | $35 |

Foreign Transaction Fee | $0 |

Branches | Yes, in Utah |

Mobile Check Deposits | No |

Cash Deposits | Yes, at a branch |

Checkbook Support | No |

Early Direct Deposit | No |

ATM Availability | No |

Customer Service Number | 801-595-7000 |

Customer Service Hours | 9 AM-5 PM (MST) |

Mobile App Availability | None |

Bill Pay | No |

FDIC Certificate | |

Promotions | None |

Continental Bank Review

-

Interest Rates

-

Customer Service

-

Tools and Resources

-

Fees and Charges

-

Ease of Use

-

Products and Services

Overall

Summary

Continental Bank is an FDIC-Insured bank that offers competitive rates on savings accounts and certificates of deposit.

Pros

- Competitive interest rates

- No monthly maintenance fees

- $1 to open

Cons

- Must move money through a linked account

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Robert Farrington