Did you know the average overdraft fee is around $35? That’s an unnecessary expense that can really add up quickly.

Vola promises a solution to help you permanently avoid overdraft fees through instant cash advances. But the catch is that you’ll have to pay a monthly fee for access to this opportunity.

Let’s take a closer look at what Vola has to offer.

Vola Details | |

|---|---|

Product Name | Vola |

Min Initial Load | None |

Monthly Fee | $9.99/mo |

Savings Reward | None |

Promotions | None |

What Is Vola?

Vola is a cash advance app that was founded in 2017. The driving force behind the app was to provide cash flow solutions to people with low credit scores or no credit scores.

Since its inception, Vola has been able to save its customers $15 million in overdraft fees. That’s a significant amount of money that was kept in consumer pockets with Vola’s help.

What Does It Offer?

Let’s take a look at what sets Vola apart from the crowd.

Instant Cash Advances

Like other cash advance apps, you can receive funds before your paycheck hits your checking account. Essentially, that means you’ll be able to mitigate any temporary cash flow issues.

It’s straightforward to get a cash advance through Vola. After you connect an approved bank account, you can select an advance amount of up to $300. You won’t encounter a credit check or interest rate when you receive a cash advance through Vola.

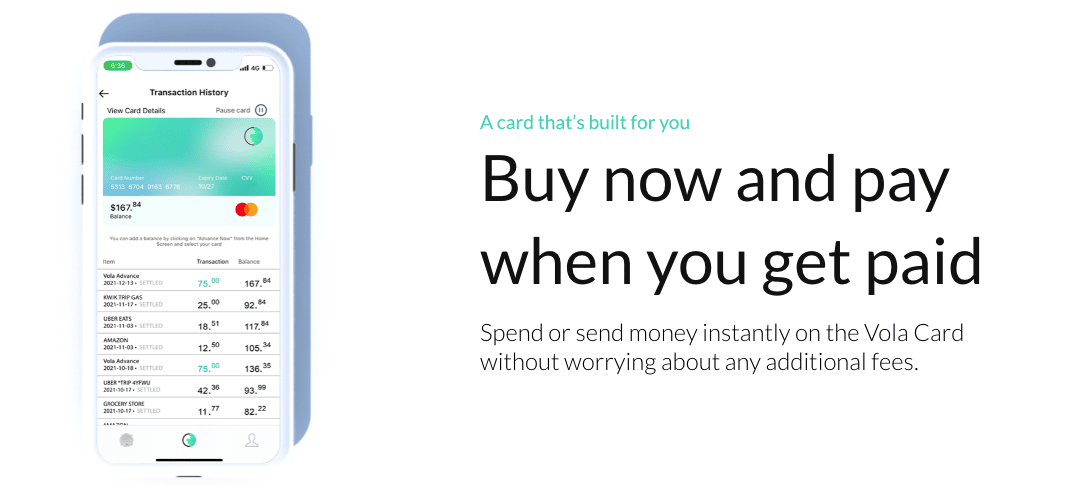

Virtual Vola Card

If you don’t want the cash advance to go straight to your checking account, you can request a virtual Vola card.

After you make this request, subsequent advances are sent to the card. You can also use this card to make purchases.

Spending Insights

A closer look at your spending patterns can help you break down exactly where your money goes. If you are struggling to make ends meet, this spending insight could help you find ways to trim your budget.

Are There Any Fees?

It’s important to note that Vola isn’t very transparent about its fee structure. But if you dig into the terms and conditions, you’ll find that Vola charges its users a monthly fee that ranges from $2.99 to $28.99.

That’s a big range!

But beyond the monthly fee, Vola states there are no other charges to consider.

How Does Vola Compare?

Vola is not the only cash advance option out there.

Earnin is one great Vola alternative. Earnin has a more transparent fee structure. In fact, Earnin is free to use. But you’ll have the option to tip if you can afford it. The downside of Earnin is that it only offers cash advances of up to $100 at first, which can be raised to $500 over time.

Another good option is Albert. It offers cash advances of up to $250. Many of Albert’s services are free. But you can upgrade to a paid account starting at $4 per month.Header |  |  | |

|---|---|---|---|

Rating | |||

Cash Advance Limits | $300 | $500 | $250 |

Fees | $9.99/mo | $0 | $4/mo |

Banking | |||

Cell |

How Do I Open An Account?

If you want to use Vola, you’ll need to have a bank account that meets the following requirements:

- At least three months old

- An average balance of $150 or more

- Shows income

- Shows regular activity

If you meet those requirements, you can sign up through the mobile app. Be prepared to provide information about your bank account to finalize your account setup.

Is It Safe And Secure?

Vola works with Plaid to securely link your bank account to the platform. Since Plaid is one of the most trusted bank connection providers, your information should be safe with Vola.

Additionally, your personal information won’t be shared or sold to third parties for commercial purposes. With that, you can feel comfortable working with the platform.

How Do I Contact Vola?

If you want to get in touch with Vola, the company offers an option to leave a note through its website. Other ways to get in contact with the company include its Facebook and Instagram accounts @volafinance.

If you decide to use Vola, you should expect a good experience through the mobile app. Vola Finance has earned 4.5 out of 5 stars on the Apple App Store. Plus, 4.7 out of 5 stars on the Google Play Store.

But the D- rating by the Better Business Bureau customer reviewers is cause for concern.

Is It Worth It?

The monthly subscription fee makes Vola a bit of a wildcard. At $2.99 per month, you might find the service worthwhile. But at $28.99 per month, you might be better off saving the money to avoid overdraft fees on your own.

Unfortunately, the information provided by Vola about the monthly fee structure is rather obscure. It seems that there are ways to lower your monthly fee, but it's unclear. For example, you might unlock a lower fee by using your Vola card more regularly, but it doesn't say how much.

Although Vola offers a relatively high cash advance option, other cash advance options should be enough to make a difference. For example, Earnin offers $100 cash advances without charging any fees.

Vola also offers budgeting assistance by breaking down your spending patterns. But you can find free services to take care of this part of your financial life.

Depending on your situation, Vola might be a good fit. If not, consider these alternatives.Vola Review

-

Commissions and Fees

-

Customer Service

-

Ease of Use

Overall

Summary

Vola is an app that promises a solution to help you permanently avoid overdraft fees through instant cash advances. The app charges a monthly fee, but find out if it’s worth considering if you want to avoid overdraft fees.

Pros

- $300 cash advance options without interest

- Fast advances

- Available nationwide

Cons

- Lack of transparency about the fee structure

- Concerning Better Business Bureau (BBB) ratings

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak