Although comparing mortgage rates across multiple lenders can be tedious, Simplist Mortgage is cutting through the slog of a search process for you. The platform helps you easily comparison shop for the best mortgage rates with a single application.

There’s no getting around the fact that buying a home is expensive. The average mortgage payment is sitting around $2,064 for a 30-year fixed-rate mortgage. But the interest rate attached to your loan may have a big impact on your costs. Even a small change in the interest rate can save you thousands over the life of your loan. Read our Simplist Mortgage review to see how it can make your home-buying experience easier and less expensive.

Simplist Mortgage Details | |

|---|---|

Product Name | Simplist Mortgage |

Service | Mortgage comparison shopping |

Types of Mortgages | Conventional, Jumbo, FHA, VA |

Fees | None |

Promotions | None |

What Is Simplist?

Simplist Mortgage is a digital mortgage marketplace. The company was founded by Chris de la Motte and Anthony Sherman after Motte encountered a challenging mortgage shopping experience.

The team’s mission is to help homebuyers get the best mortgage on the market. And it’s committed to helping home buyers, whether or not they fit into the traditional employment mold.

What Does It Offer?

Simplist Mortgage offers a streamlined way to comparison shop for the best mortgage out there. Here’s what the platform has to offer.

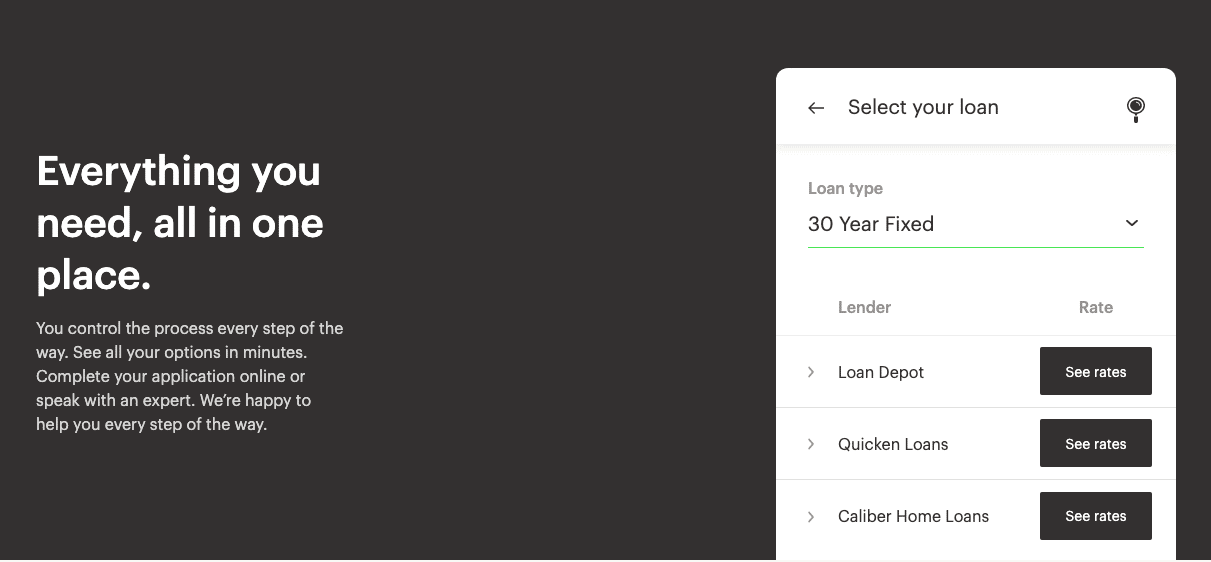

Comparison Shopping Made Easy

The process of working with Simplist Mortgage starts with a short application. Within as little as five minutes, you could have your pre-approval in hand.

From there, you can start browsing the best loan options out there. You can select a loan from one of the dozens of lenders. The ability to compare rate options in a single place can help you save more money.

Even a small interest rate difference could save you thousands.

Streamlined Mortgage Closing

Once you select a loan, you can let Simplist know to seek approval on your application. Depending on the situation, you could get full approval in as little as 48 hours.

Within the Simplist platform, you can upload documents, order appraisals, and more. You’ll even schedule closing online or with a Simplist Loan Expert. As a home buyer, you’ll appreciate having all of these details in one easy-to-use platform.

Soft Credit Pull

When you apply with Simplist, the company will conduct a soft credit pull. With that, your credit score won’t be affected in this initial stage.

If you decide to move forward with a particular mortgage, a hard credit inquiry will be initiated. The application should only take a few minutes to complete.

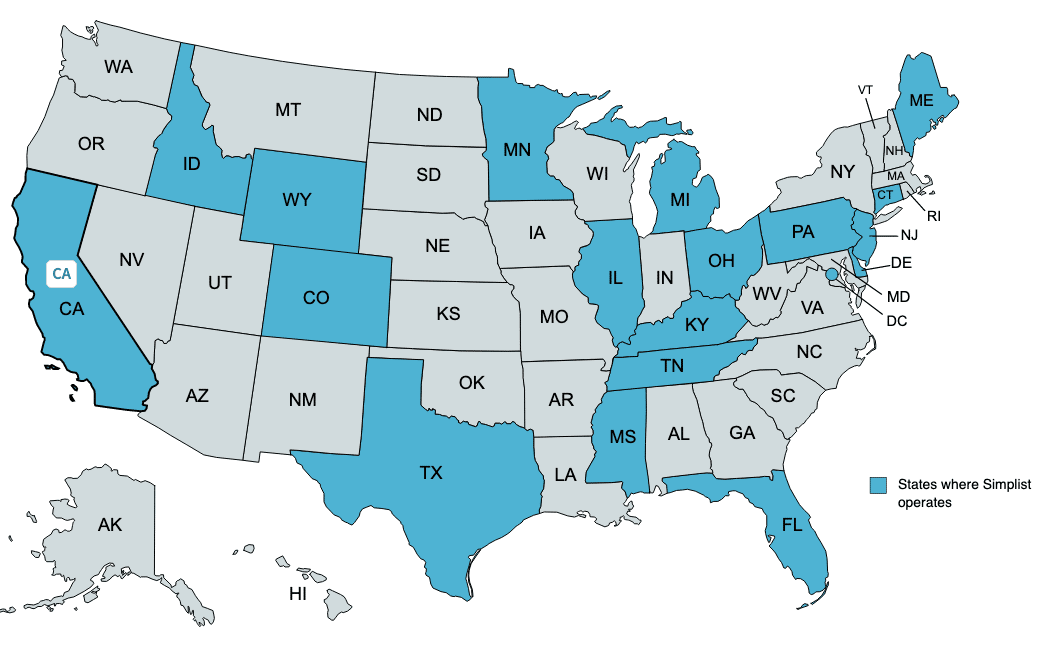

Availability

Simplist is available in a large number of states. But not everywhere.

The company originates mortgages in California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Kentucky, Maine, Minnesota, Mississippi, Montana, New Jersey, Ohio, Pennsylvania, Tennessee, Texas, Washington D.C., and Wyoming.

The company is planning to expand into other states soon.

Are There Any Fees?

It’s free to apply with Simplist and you can easily compare rates without an application or processing fee.

However, if you move forward with closing on the loan, you will be charged a fee. The exact fee structure isn’t available but you’ll see the exact costs in the loan estimate disclosure form after submitting the full application.

How Do I Contact Simplist Mortgage?

You can contact Simplist through calling 646-992-4696, the chat box on their website, or by scheduling time with a Loan Expert. Additionally, you can connect through Instagram @Simplist, Facebook @simplistmortgage, and LinkedIn @Simplisttech.

The company has earned an A from the Better Business Bureau.

How Does Simplist Mortgage Compare?

Simplist Mortgage isn’t the only way to compare mortgage rates across lenders. But what makes this company stand out is the ability to complete the entire mortgage process within their easy-to-use platform.

Morty is a broker platform that helps you compare mortgage rates and finalize the closing process. The choice between the two can be easy depending on where you live. Keep in mind that Morty isn’t an actual lender and their services are currently available in 36 states.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Purchase Loans | |||

Refinance Loans | |||

Conventional | |||

VA | |||

Home Equity | |||

Cell |

How Do I Open An Account?

If you want to explore your mortgage options with Simplist Mortgage, start by selecting ‘I’m purchasing’ or ‘I’m refinancing.’ This will prompt you to create an account.

At this point, the platform will ask for some information. Be prepared to provide:

- What kind of property you are purchasing

- The location

- Estimated purchase price

- Down payment amount

- Purchase timeline

- Current address

At the end of this process, you’ll create a password. From there, you can start comparing your mortgage options.

Is It Safe And Secure?

Simplist Mortgage uses bank-level encryption practices to keep your information safe throughout the home buying process. If you run into any concerns, reach out to your Simplist Loan Expert.

Is It Worth It?

Simplist Mortgage is a very useful tool for soon-to-be homeowners. The platform allows you to painlessly compare rates.

When you work with Simplist, you know that you are getting the best possible rate for your mortgage. And ultimately, that could save you thousands. Since there isn’t a hard credit inquiry to explore your options, it doesn’t hurt to take a look at what Simplist has to offer.

If you don't have the time or energy to hunt around for the best rate and crave simplicity, this platform is solving a big challenge.

However, if you want to expand your research in conjunction with Simplist, check out our review of the best mortgage lenders to keep on your radar.

The Best Online Mortgage Lenders

- Pro tip for first-time homebuyers: Get at least three quotes before you choose a mortgage in order to determine how much you can really afford. Check out our review.

Simplist Features

Services | Mortgage comparison shopping |

Types of Properties You Can Get Loans For |

|

Purchase Mortgages | Yes |

Refinance Mortgages | Yes |

Fixed Rates | 15, 20, and 30 years |

Variable Rates | 5/1, 7/1, and 10/1 ARM |

Conventional Loans | Yes |

VA Loans | Yes |

Second Mortgages | No |

Home Equity Loans | No |

Fees | None |

Soft Credit Pulls On Rate Quotes | None |

Customer Service Schedule a Call | You can schedule a call on their website |

Customer Service Number | |

Customer Service Social Media |

|

Mobile Availability | None |

Promotions | None |

Simplist Mortgage Review

-

Commissions and Fees

-

Ease of Use

-

Features

-

Customer Service

-

Availability in 50 States

Overall

Summary

Simplist Mortgage is a platform to help you easily comparison shop for the best mortgage rates with a single application.

Pros

- Comparison shop for the best mortgage rate

- Works with buyers of all backgrounds

- Quick pre-approval and closing process

Cons

- Not available in every state

- Closing cost

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Robert Farrington