Klarna is a provider of a buy now, pay later (BNPL) platform. Klarna, which doubles as a shopping app, allows you to make purchases without paying interest. This interest-free perk may indulge your temptation to overspend. Afterall, you’re not paying anything extra beyond the cost of your purchase.

This growing trend, which rose due in part to Covid-related financial hardships, the number of BNPL users is expected to reach 59.3 million. Before you decide to make a purchase using a BNPL option with Klarna, here’s what you need to know.Klarna Details | |

|---|---|

Product Name | Klarna |

Monthly Fee | None |

Interest Rate For Most Purchases | 0% |

Terms For Repayment | 30 days, with the option to spread over 4 payments |

Promotions | None |

What Is Klarna?

Founded in 2005, Klarna is an online shopping portal that gives customers more time to pay. The company is headquartered in Columbus, Ohio and provides interest-free financing for 45 days when customers shop at any of Klarna’s 400,000 retail partners. Klarna provides financing for customers who don’t have enough cash to pay for their consumer purchases. The company may also offer installment loans on larger purchases. Klarna positions installment loans as an alternative to revolving credit card debt, which is the balance you carry from credit cards that usually come with a variable interest rate.

What Does It Offer?

Klarna is a shopping platform, but it has a unique hook. It offers several different BNPL plans including two plans that don’t require you to pay interest.

Interest-free Financing Over 4 Payments

Klarna has an interest-free plan called Pay in 4, which requires you to make a 25% down payment. Then you’ll make a payment every two weeks until your item is paid off. The two-week timing is designed to align with pay schedules, so you can make on-time payments.

Buy Now, Pay in 30 Days

If you’re someone who wants to try before you buy, Klarna’s no-money-down, Pay in 30 plan may be a good fit for you. On this plan, you get an interest-free 30-day loan for purchases made through Klarna. When you decide to keep a product, you’ll pay for it after the 30-day trial is up. If you return the product, you don’t have to pay for it at all.

It’s worth noting that some credit cards, including rewards credit cards, offer an interest-free window. If you’re really looking to optimize your spending patterns, a credit card may give you rewards and the interest-free loan you’re seeking. Plus, if you pay off the card each month, you will automatically improve your credit score.

Instant Credit Decisions

Each time you apply for a loan, Klarna will perform a soft credit check. It will also verify your personal information, and check your outstanding balances on the platform.

You’ll know whether you’re approved for Klarna’s credit plans within a few seconds of applying. This instant decision makes the payment options from Klarna almost as easy to use as a credit or debit card.

Installment Loans

If you’re making a larger purchase, Klarna’s interest-free installment plans may not be an option. As an alternative, Klarna partnered with a bank to offer monthly installment loans.

With these loans, you’ll make equal monthly payments until your loan is paid off. These loans carry a fairly high 19.99% interest rate, which is higher than the average credit card interest rate of 16.65%.

Despite the high-interest rates, Klarna’s installment loans have a few redeeming qualities. First, the loans won’t trap you in a cycle of revolving debt.

After a set number of months, you won’t owe payments anymore.

Second, payment history for installment loans is reported to the credit bureaus, which may help you build your credit score.

Negative Information May Be Shared With Credit Bureaus

If you use one of Klarna’s interest-free financing plans, the company won’t report your on-time payments to the credit bureaus. That means your credit score isn’t affected when you use one of these plans. This may be a positive or negative, depending on what your credit situation looks like.

However, Klarna may report late or delinquent payments to the credit bureaus, which will be a drag on your credit score.

Are There Any Fees?

When you use Klarna’s Pay in 4 plans, you won’t pay any interest, and the late fee is capped at $7 or 25% of the original purchase price.

You’ll also pay no interest on the Pay in 30 plans, which give you an interest-free loan for 30 days.

If you opt for Klarna’s monthly financing, you’ll pay a 19.99% APR and late fees are up to $35.

How Do I Contact Klarna?

Klarna is headquartered at 29 N. High St. FL 300 Columbus, OH, 43215.

If you’re trying to resolve a problem with Klarna, you can call 844-552-7621, or start an online chat (either through the app or the website). You can also reach Klarna’s customer service team by filling out a form on Klarna’s website.

How Does Klarna Compare?

Klarna most closely aligns with Afterpay. Like Afterpay, Klarna offers interest-free financing with reasonable late fees if you fail to make a payment. Both companies earn money when they refer customers to their retail partners. They may even share some of your shopping or in-app browsing behavior with retail partners.

Klarna also offers a short-term installment loan product. This product is comparable to the 3-, 6-, and 12-month financing options from Affirm, a rival BNPL company. Affirm’s interest rates may be lower than Klarna’s 19.99% interest.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Monthly Fees | $0 | $0 | $0 |

Interest Fees | None | None | None |

Spending Limit | New, automated approval decision made per purchase | $500 | $2,500 |

Credit Score | Credit score not affected | Credit score not affected | Credit score not affected |

Cell | Cell |

The online BNPL industry is competitive, but Klarna doesn’t dramatically differentiate itself from its competitors.

It’s also worth noting that many BNPL companies market themselves as alternatives to credit cards. However, Klarna’s 30-day to 6-week financing period doesn’t stand out compared to some 0% introductory credit card rates. If you know you need to pay off the purchases in monthly installments, a credit card may be a better option.

How Do I Open An Account?

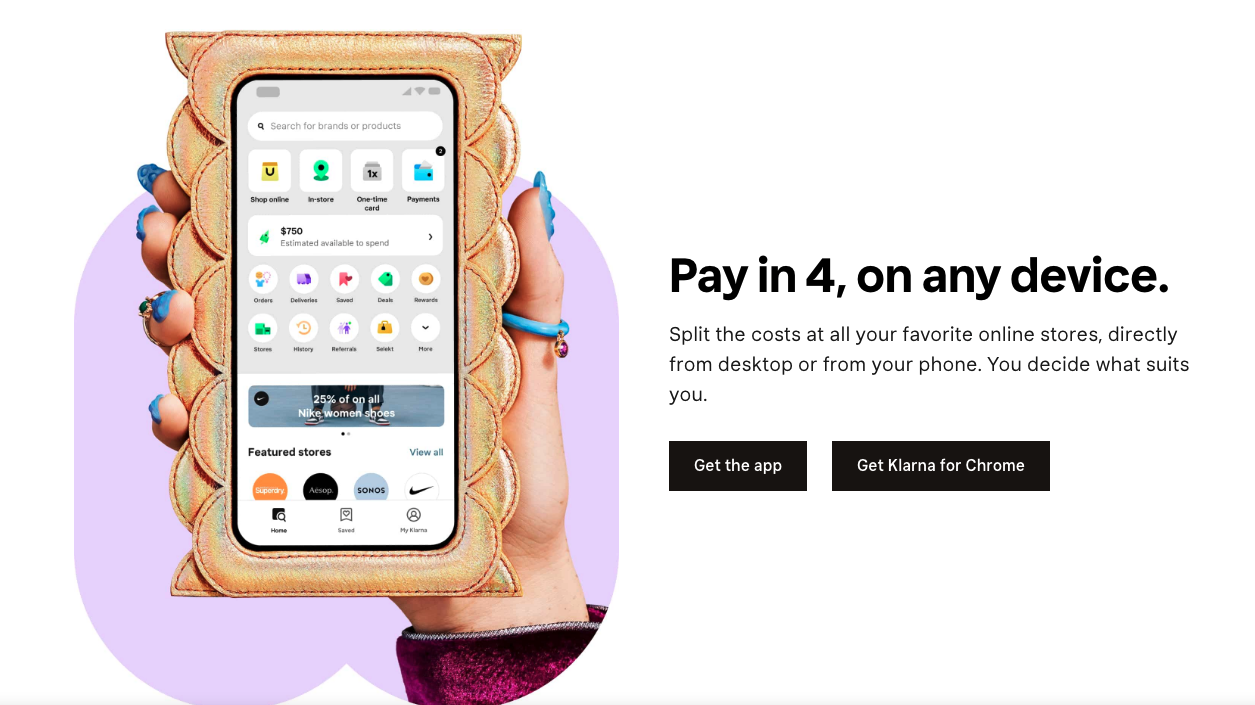

You can download the Klarna app from the App Store or Google Play. The app prompts you to enter your email address and phone number right away.

After that, you can start shopping through Klarna immediately, but you may not qualify for financing with Klarna. To qualify, you must be at least 18 years old and be a resident of the U.S. Klarna verifies that you have a valid bank account and that you can receive verifications via text before it will issue a loan to you.

Klarna also performs soft credit checks and considers your outstanding balances before issuing new loans to you. This won’t hurt your credit score, even if Klarna doesn’t issue a loan to you.

Hot Tip: Start A Budget Now

Learn how to create a budget, and gain control over your spending so you can finally achieve your financial goals.

Is It Safe And Secure?

Klarna has multiple security layers to keep payments and personal information safe and secure. Payments are secured and personal information is encrypted. Klarna shares some personal information with its affiliates including its network of retailers.

Is It Worth It?

The combination of online shopping, which can be addictive, and interest-free financing seems like it could be a recipe for debt. Despite our best efforts at self-control it can be easy to overspend when you’re spending “future money.” As long as you’re paying yourself first, and saving regularly for retirement and emergencies, there’s nothing wrong with a little online shopping.

But Klarna isn’t targeting people who are trying to arbitrage a financing deal. Their goal is to help you buy things that you can’t really afford in the first place. Like other BNPL platforms, you may feel tempted to overspend today, leaving you with fewer options tomorrow.

Taken at face value, interest-free financing is great. But if that financing results in spending beyond your means, it means nothing.

If you need money to make a necessary purchase, you can always sell old items or consider one of these side hustles. Sometimes the work associated with getting the money will keep you from spending frivolously.

Klarna Features

Product Types And Details |

|

Monthly Fees | None |

Interest Fees |

|

Repayment Terms |

|

Late Fees |

|

Return Policy | Contact retailer directly, then Klarna will pause your invoice to be updated. You will receive an email from Klarna or check the app. See Klarna's complete return policy. |

Customer Service Number | 844-552-7621 |

Customer Service Chat | Visit Klarna's support page for online customer service chat 24/7 |

Customer Service Email | |

Klarna's Address | 29 N. High St. FL 300 Columbus, OH, 43215 |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Promotions | None |

Klarna: Pay No Interest With Buy Now Pay Later Plans

-

Pricing and Fees

-

Customer Service

-

Ease Of Use

-

Interest Rates For Repayment

Overall

Summary

Klarna is a provider of a buy now, pay later (BNPL) platform. Klarna, which doubles as a shopping app, allows you to make purchases without paying interest.

Pros

- Two different interest-free financing options

- Applying has no effect on your credit score

- Late fees are never higher than $7

Cons

- Klarna may report late or delinquent payments to the credit bureaus

- Monthly financing rate higher than average credit card rates

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington