Finary.io is an app that recognizes the dearth of investment education. It aims to fill that gap by making investment education fun and social. It also allows you to pay for access to curated content called groups (although that content is not to be taken as investment advice).

Finary offers a great user interface, memes, and investment not-advice from total strangers. If it sounds like a volatile combination, it is. Here’s what you need to know about the app.

Finary.io Details | |

|---|---|

Product Name | Finary |

Min Investment | $10 |

Commission | $0 |

Types of Investments | Stocks and crypto |

Promotions | Get up to $150 in free stock when you fund your account |

What Is Finary.io?

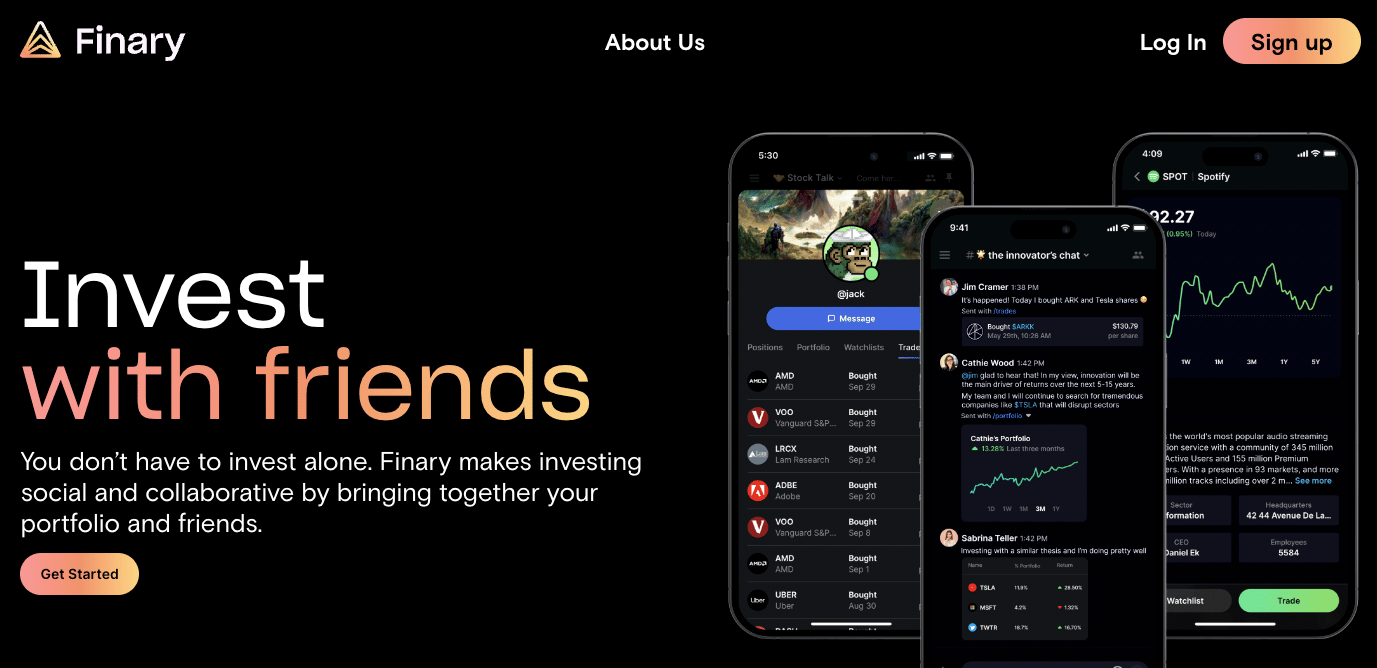

Founded in 2020, Finary.io is an app designed to help investors improve through social interactions. The app combines elements of Reddit, Twitter, and Robinhood to give users a dynamic investment experience.

You can do the following inside of the app:

- Follow hashtags

- Purchase subscriptions to insider chats

- Post chats (including GIFs, live stock tickers, and more)

- Buy and sell stocks and crypto

What Does It Offer?

One part social media, one part brokerage, and one part investment advice, Finary is tough to put in one type of category. That said, the app is intuitive and easy to use. Here are a few highlights.

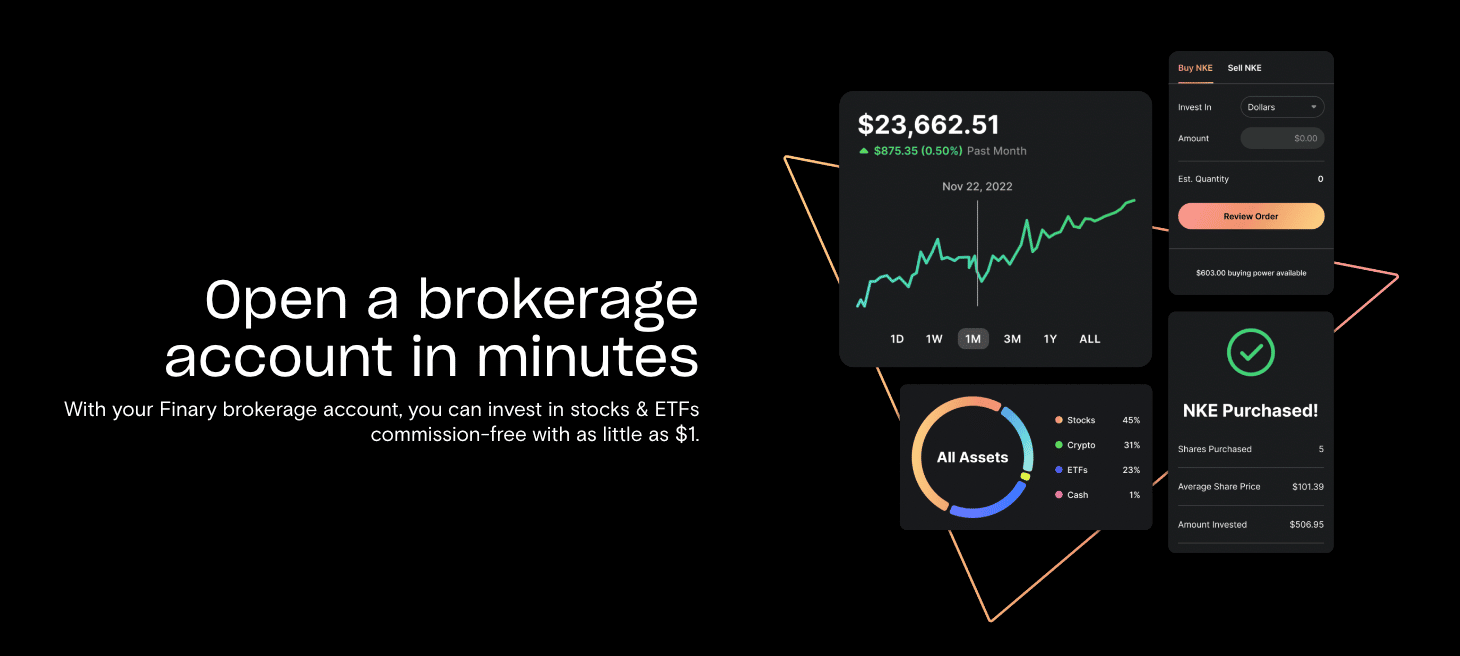

Free Stock And Crypto Trades

When you find a stock or crypto idea that ignites your passion, you can place a trade directly through the Finary app. Today, free trading fees are practically table stakes with dozens of companies offering free trades.

Nonetheless, it’s great to see that this brokerage isn’t trying to rip off young investors who don’t know any better.

Show The Receipts Of Your Great Trades

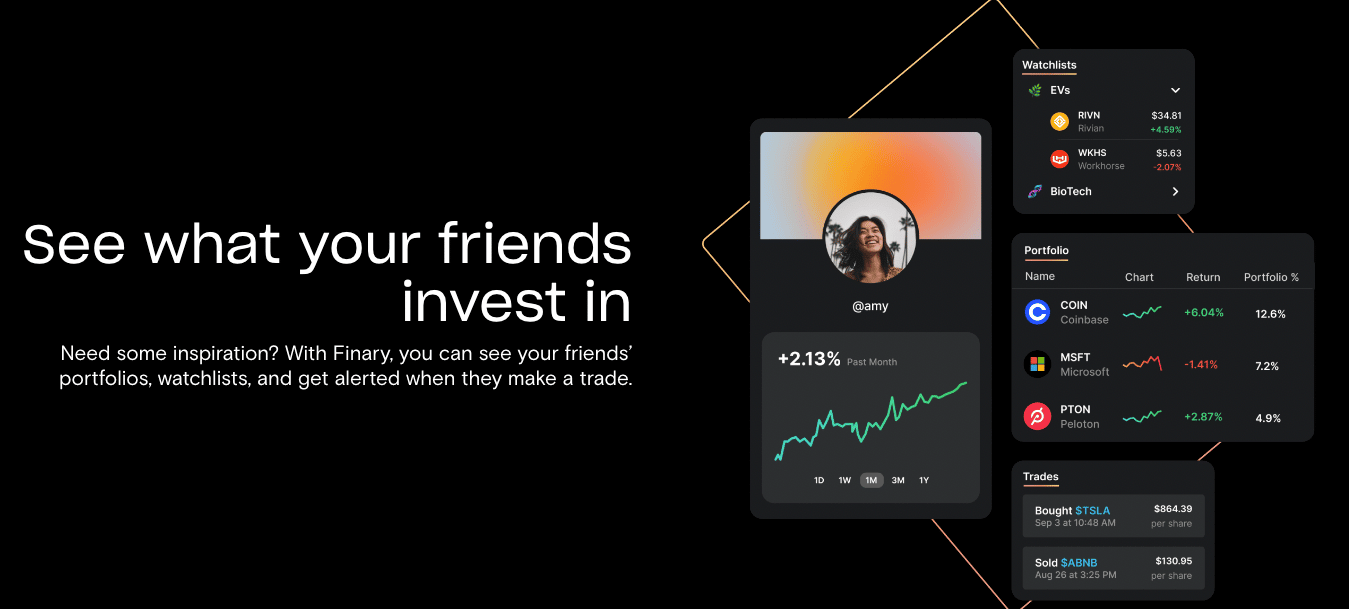

Finary verifies all trades placed on the platforms including stock or crypto trades.

You can share your verified trading performance with friends, family, or others on the app. You can also share portfolio composition, live performance charts, and other details relevant to investment and trading discussions.

Of course, the verification of trades has a subtle downside. You can share your gains but keep your losers to yourself. This could lead to some investment mistakes as you take bigger bets without considering the risk of loss.

Free Chats Within Finary.io App

Finary allows you to start chats with your friends (you can become friends with people on the platform) or you can join the general chat through the app. However, the most active chats seem to be in the curated content groups where people pay to interact.

Option To Buy Curated Content

Right now, Finary.io has two curated content rooms but the platform will likely add more over time.

- Invest With Russ focuses on long-term investing, wealth-building, and evaluating upside and downside risk.

- WallStreetStonks focuses on meme investing. Both have a similar number of members, and users pay the same rates for either paid service.

Free Stock When You Sign Up

When you sign up for Finary.io and fund your account with at least $10, you can select one stock (worth up to $150) to put in your account. This signup bonus can be a meaningful head start on your investments.

Are There Any Fees?

Finary.io does not charge any fees for buying and selling stocks or crypto. It also doesn’t allow users to trade on margin.

If you want, you can pay to get on one of the curated paid channels. This requires a payment in the form of a one-time fee, monthly, or annual fee. It’s $14.99 per month or $149.99 per year.

The content in these channels isn’t investment advice. It’s developed for informational and entertainment purposes only. It’s also the way that Finary and its content creators get paid. Finary and content creators split the revenue earned through subscriptions.

How Do I Contact Finary?

Headquartered in New York City, Finary is at the heart of one of the world’s largest financial centers. But the team has a surprisingly Silicon Valley approach to customer service.

The best way to contact Finary is through its in-app Bugs and Feedback chat. Developers respond to the chat within a few minutes and answer questions quickly and accurately.

If you aren’t yet a customer you can email support@finary.io or hello@finary.io with questions.

How Does Finary Compare?

At first, comparing Finary to apps like Robinhood or M1Finance makes sense. These are apps that promote free trading and have research and idea generation baked into the platform.

However, Finary’s social element is more prominent than the ticker symbols and technical details that dominate Robinhood and M1Finance.

Public is another brokerage with a social element, though all of the content on Public is freely available whereas users on Finary pay for certain content elements.

Header |  | ||

|---|---|---|---|

Rating | |||

Commissions | $0 | $0 | $0 |

Min Investment | $10 | $0 | $0 |

Banking | |||

Cell |

Ultimately, Finary is probably best compared to Motley Fool (where you can pay for curated stock information) or Morningstar which focuses more on portfolio analysis, Mutual Funds, and ETFs.

Given the long track record of both Motley Fool and Morningstar, it makes sense to feel more trusting of these resources over Finary.

Header | ||

|---|---|---|

Rating | ||

Annual Membership Fee | $249/yr | $99/first year |

Stock Screening | Yes | Yes |

Fund Screening | Yes | No |

Research Tools | Yes | Yes |

Promotions | 7-Day Free Trial | 30-Day Free Trial |

Cell |

How Do I Open An Account?

Download Finary from the App Store or Google Play Store. Make sure the Finary you download has a logo that looks like this. The other Finary is a subscription brokerage mainly for Europeans.

Because Finary is a brokerage, you’ll need to provide a lot of details to start an account. This includes creating a username and password (along with your email address). This is enough information to get you into the app (or on the website).

But you must add your full name, current address, employment status, income, source of income, and your Social Security Number to open an account. Finary verifies the account (this can take a few minutes to a full day). After that, you can log in, fund your account and start investing and learning.

Is It Safe And Secure?

From a digital security standpoint, Finary covers all its bases. It requires multi-factor authentication and verifies accounts before it allows you to fund an account.

The app uses secure third-party integrations to allow you to transfer money, and its personal information is encrypted using bank-level standards. While online investing always presents a risk, the risk with Finary is no more or less than you would see elsewhere.

Additionally, Finary makes it easy to cancel your subscriptions so you won’t need a bill-canceling service to terminate your monthly fees.

Is It Worth It?

Even though the educational concept makes sense, there are other apps and services that better fulfill that component without nudging investors to make big bets on short-term deals. For those who really want to learn the ins and outs of investing, there are better platforms and resources.

Reasons why Finary may not be worth it:

- The app is designed to encourage young people (especially men) to treat their money like a video game.

- It specifically celebrates trades without recognizing the downside pitfalls of high-frequency trading.

- People with no credentials other than recent luck can appear to look like geniuses on the platform, giving other investors the wrong idea and inspiration.

It’s hard to make life-changing money as a meme stock investor, and Finary nudges people towards meme investing. Through its subtle nudges, the app combines all the elements of online sports betting and social media.

If you want to learn about investing, consider an investment club. These clubs are designed to connect with people who will hold a critical lens to your investment ideas rather than cheering your ten-bagger (without knowing that you’re still in the red due to your other bad trades).

Finary Features

Service | |

Optional Curated Content |

|

Subscription Fee For Curated Content |

|

Commission Fees | $0 |

Membership Fee | $0 |

Minimum Investment | $10 |

Customer Service Email | support@finary.io hello@finary.io |

Mobile App Availability | |

Promotions | Up to $150 in free stocks |

Finary.io Review: Investing And Education With A Social Twist

-

Commission and Fees

-

Customer Service

-

Ease of Use

-

Products and Services

Overall

Summary

Finary.io is an app that focuses on investment education and aims to make learning social. It also allows you to pay for curated content.

Pros

- Get a free stock when you sign up

- Excellent, easy-to-use interface

- Good forum for sharing investment ideas

Cons

- Social signaling and recency bias without requiring any real expertise

- Easy to trade your account down to nothing

- Difficult to get critical feedback on an investment idea

- No retirement accounts

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak