When you join a tech company, you may need to navigate through stock options, an upcoming IPO, or a larger salary that suddenly pushes you into a new tax bracket. It may spur you to seek financial advice from an expert who understands the intricacies that come with being a tech worker.

Compound is a company dedicated to serving these financial planning needs, specifically geared toward tech workers. The company helps with asset management as well as tax advice. Compound supports those in the tech sector by explaining offers, optimizing tax efficiency during corporate buyouts, and planning for startup financing.

Compound Details | |

|---|---|

Product Name | Compound |

Annual Fee | $3,000 to $50,000 per year depending on a variety of factors. |

Services |

|

Promotions | None |

What Is Compound?

Founded as part of the 2019 Y-Combinator startup accelerator, Compound calls itself the personal finance tech company by tech people for tech people. The company offers personal finance advice, tax planning, and asset management services, with a relentless focus on serving people in the tech sector.

Tech employees often command super-high salaries when they work for Silicon Valley giants, so it's common to have complicated financial situations like stock options. Tech workers may also deal with joining startups with a high equity compensation or work on establishing a business of their own. All of these factors present unique challenges and opportunities.

What Does It Offer?

Compound provides full-service tax and financial planning advice for tech workers. It allows you to engage with its financial professionals using:

- A one-time project fee

- An ongoing flat fee

- An assets-under-management (AUM) fee

Help Understanding Your Finances

Compound’s primary service is financial advice and offers unique insights for tech workers. It helps tech workers at every step of their financial life including negotiating an offer before joining a startup or tax advice about what to do when a company goes public.

Compound also publishes manuals for seven different tech worker profiles to help you learn about your own situation.

Tax Planning

Compound’s team of financial advisors includes CPAs that provide tax planning advice. While tax planning is beneficial especially for those who are:

- Working for equity in a private company

- Have stock options

- Looking to sell their companies

Compound comes prepared to help you figure out the most tax-efficient strategy for managing your finances.

Asset Management

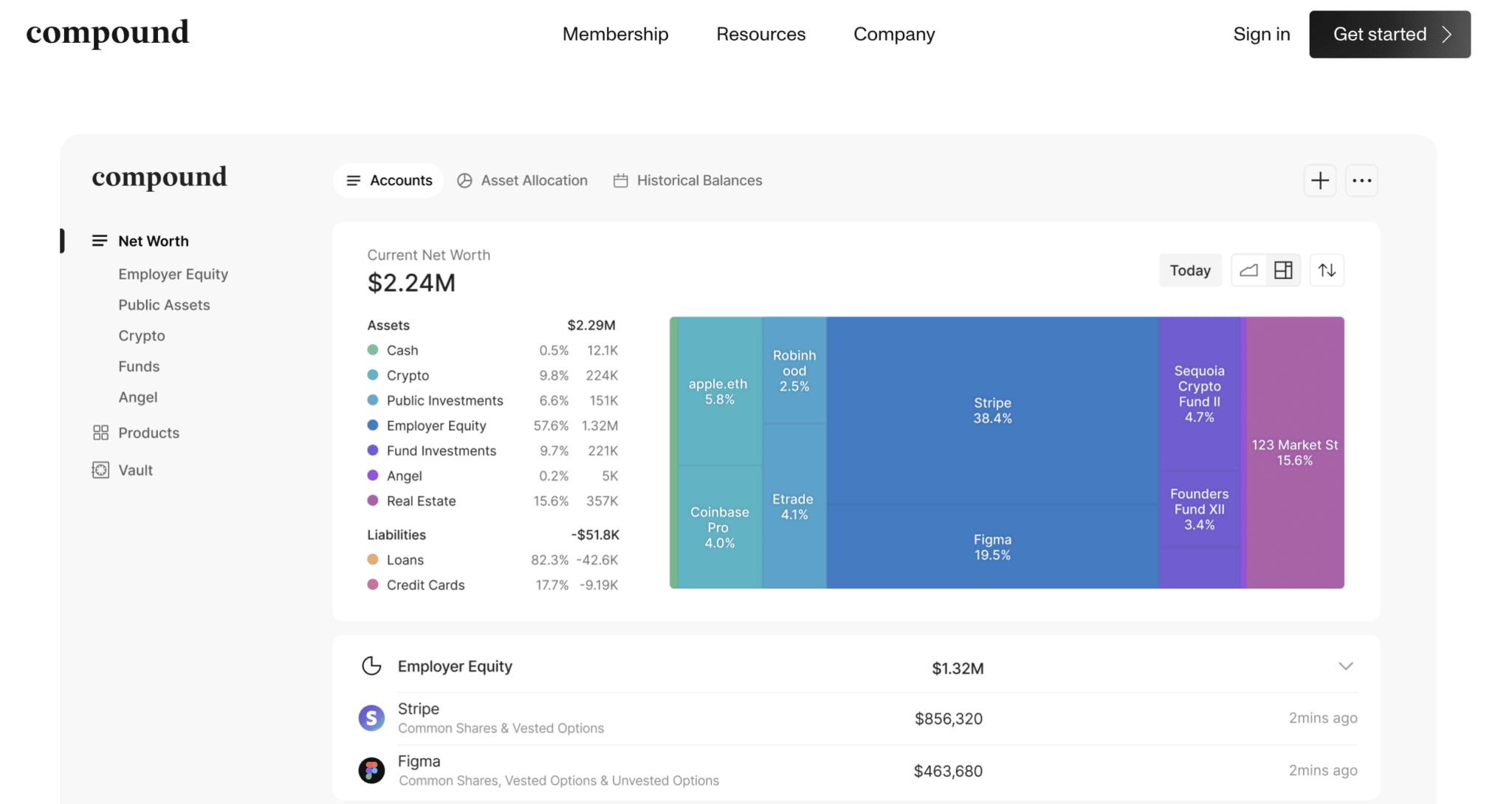

Compound is more than a Robo-advisor. Its asset management service is an automated portfolio management tool that accounts for all aspects of your portfolio including your non-traded equity.

You can choose between a "foundational portfolio" or a custom-indexed portfolio that allows you to select your own investments.

Data Visualizations

Most portfolio analysis tools focus on stocks, bonds, and cash. A few integrate real estate or crypto assets into your portfolio.

Compound’s data visualization and portfolio analysis tool allows you to look at every part of your net worth including the value of equity tied up in an untraded company.

Understanding how much of your net worth is tied up in one non-traded tech company can help you make great decisions with the rest of your portfolio.

Personalized Attention

Compound helps you optimize your finances so that you can focus more on your life and tech career. Financial planning often requires frequent touch bases to help you through tricky scenarios or to optimize your finances.

While you’ll pay for all the attention you receive, the advice you receive can help you dramatically increase your net worth or the income you receive.

Are There Any Fees?

Compound is a fee-for-service financial advisory company. It allows people to engage the company with a variety of fee models. These models include:

- Project-based work: If you want to engage Compound for a one-time activity (such as a financial plan, help navigating an IPO, or something similar) you can expect to pay $400 to $30,000 depending on the complexity and scope of the project. Compound will estimate the cost before you start working together. Most tax planning will be project-based work.

- Annual fees: Using a tiered service model, you can receive wealth management and advisory services for a flat annual fee. The fee ranges from $3,000 to $50,000 per year depending on a variety of factors.

- Assets under management: If you prefer to have fees taken from your assets under management Compound charges 0.30% to 0.45% depending on several factors. This pricing is in line with the cost of major Robo-advisors.

How Does Compound Compare?

Compound offers to help tech workers with every part of their financial life. It isn’t just a tax preparation firm, and it doesn’t offer financial plans to everyone. Instead, it is a high-cost, high-touch company that can help you navigate the parts of financial life that are specific to working in the tech sector.

Whether you work in the tech sector or not, you may be able to find less expensive and high-quality advice by working with financial advisors from WealthFront, Betterment, or Vanguard. You may also consider financial coaches from The Financial Gym.

Getting personalized financial advice often pays off in ways that you don’t expect. Not everyone needs professional financial advice, but you may be surprised by the ways you benefit.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Annual Fee | 0.25% | 0.25% to 0.40% | 0.15% to 0.30% |

Min Investment | $500 | $0 | $3,000 to $50,000 |

Advice Options | Auto | Auto and Human | Auto and Human |

Banking? | |||

Cell |

How Do I Contact Compound?

Compound has employees in North America and Europe, but its main headquarters is located at

832 Sansome Street Floor 1 San Francisco, CA 94111.

The best way to contact the company is through the “Get Started” button on the website. Compound also published its financial advisory main phone number as 415-417-1180.How Do I Start Working With Compound?

To start working with Compound, fill out the “Get Started” form on the website. It will request your name and email address along with your reason for contacting Compound.

You’ll set up a 20-minute call so that you can gain a better understanding of what fee structure makes sense for your needs.

If you commit to working with Compound, you’ll need to provide more details and documents so that Compound can help with tax planning, financial advice, or asset management.

Is It Safe And Secure?

As a company designed for high net-worth tech workers, Compound has a focus on digital privacy and security. Compound secures personal and asset information to some of the highest industry standards.

The initial contact forms request very little information so that you can understand the approach and process before providing personal information.

If you choose to work with Compound, you can transfer files and digital assets via a secure and encrypted portal.

As many tech workers know, there is always a risk of data breaches or attacks from malicious actors. Sharing financial information is never perfectly safe, but Compound does its best to de-risk the situation.

Is It Worth It?

While Compound’s sticker price may seem high, its prices are in-line with the cost of receiving professional financial planning advice elsewhere. Because Compound has a focus on tech workers that may benefit from IPOs or working with startups, it has a unique value proposition for many people.

That said, if you aren’t part of the Silicon Valley tech scene, you may want to get your financial advice elsewhere. Advice tailored to people working in startup companies may not apply if you do data engineering for the government, or software development for an established retailer.

Compound’s asset management services are shockingly budget-friendly. Robo-advisors are only a touch less expensive and they don’t come with the option for personal financial advice.

If you work in tech, you may want to engage Compound for asset management, so you can have access to great financial advice if you need it in the future.

Compound Features

Services |

|

Project-Based Fees | Expect to pay $400 to $30,000 depending on the complexity and scope of the project. |

Annual Fees | $3,000 to $50,000 per year depending on a variety of factors. |

Assets Under Management Fees | 0.30% to 0.45% depending on several factors |

Access to Human Advisor | Yes |

Website Customer Service | The best way to contact the company is through the “Get Started” button on the website. |

Advisory Main Phone Number | 415-417-1180 |

Customer Service Email | support@wealthfront.com |

Company Address | 832 Sansome Street Floor 1 San Francisco, CA 94111 |

Web/Desktop Account Access | Yes |

Mobile App Availability | No |

Promotions | None |

Compound Review: Financial Advice For Tech Workers

-

Commission and Fees

-

Customer Service

-

Ease of Use

-

Investment Advice Options

Overall

Summary

Compound is a company dedicated to serving financial planning and tax needs specifically for tech workers.

Pros

- Deep knowledge of taxes and tech worker finances.

- Low-cost asset management and portfolio construction services.

- Option to get one-time or ongoing advice.

Cons

- Can be very expensive to work with a professional team.

- There is currently a waiting list to start working with Compound.

- Compound’s advice is not for general audiences.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington