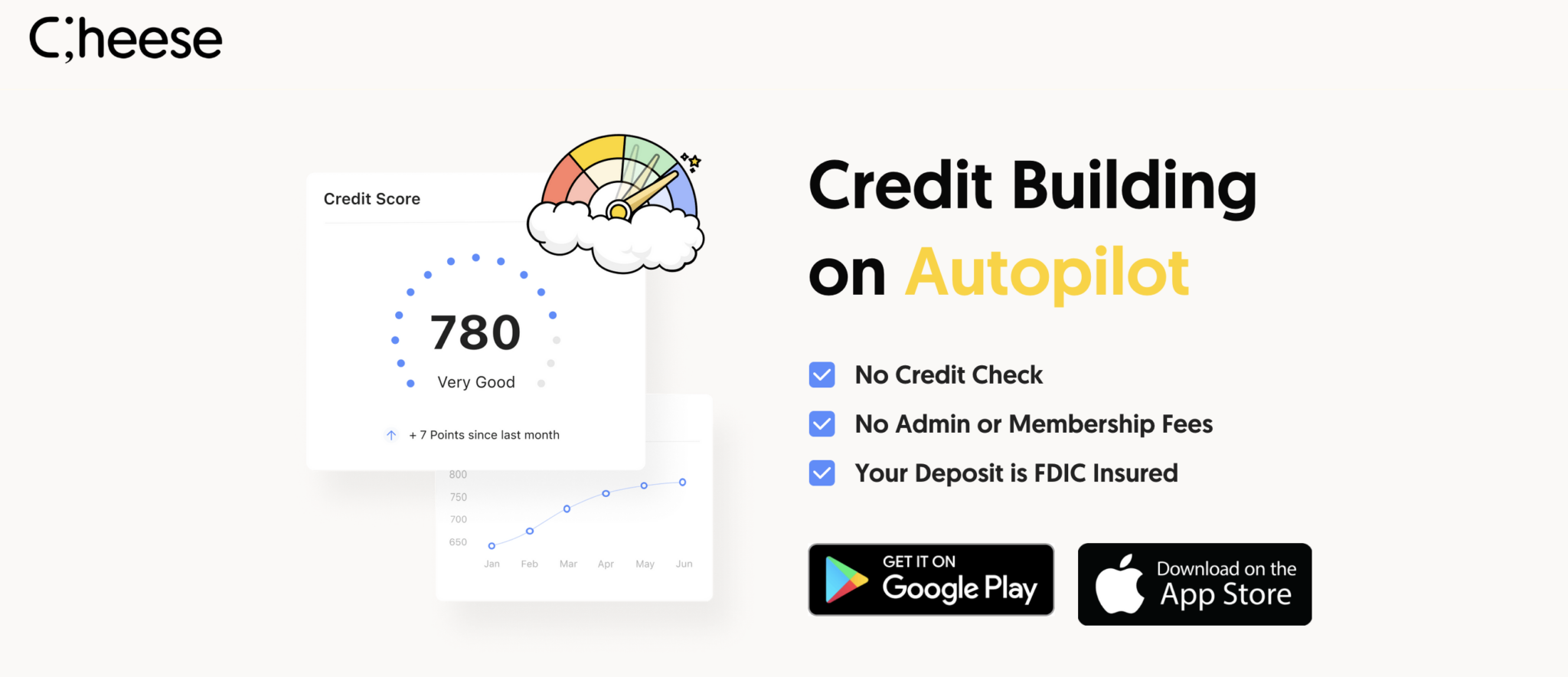

Cheese is a credit-builder that allows you to build a credit history at all three major credit bureaus.

When you’re ready to make a hefty purchase, like a car or house, you need good credit to help you get the best interest rates. Lower rates mean a less expensive purchase, higher rates mean you’re paying more—and the determining factor in all of it is your credit score.

Lenders, banks, and financial institutions want to see that you are a responsible borrower through a varied mix of credit, such as credit cards, personal loans, and student loans. When you make on-time payments every month, you’re showing you are being responsible.

If you’re fresh out of college and new to credit or maybe made a few bad decisions and need to establish stronger credit, consider a credit building platform like Cheese. They rebranded to focus on helping consumers improve credit. They used to be called Cheese Banking and focused on helping Asian American immigrants with their banking needs.

Here’s what Cheese promises to deliver, why you may consider them, and how they compare to other credit building solutions.

Quick Summary

- Cheese Credit Builder is a loan to help you build your credit.

- You can get the principal of your loan returned to you at the end of the loan, minus interest.

- Your future payments will be auto-paid through your connected bank account so that you don’t need to worry about forgetting the payments.

What Is Cheese?

Cheese is a credit builder company designed to help those with no or poor credit history establish credit. The way they do that is through giving you a credit builder loan.

What Is A Credit Builder Loan?

This is a fixed loan in which you make monthly payments. Even though it’s called a “loan,” you won’t be able to get your hands on the cash until later. Think of it as the reverse of a traditional loan.

Credit builder loans are specifically designed to help those with poor credit or thin credit. You get the loan but it’s put into a savings account for you (some companies offer CDs, or certificates of deposit as well), make monthly payments, and then you get the money back at the end of the loan term. The term is how long you choose to pay off the loan, for example, 12 or 24 months.

During this time, the credit builder company reports your on-time payments to all three credit bureaus, and you get to improve your score. Keep in mind you have to pay interest each month—and this figure depends on where you live.

At the end of the term, you get the monthly payments you made (AKA, your money), minus the interest you paid.

How Cheese’s Credit Builder Loan Works

Cheese offers a credit builder loan, which isn’t exactly like a traditional loan, which is when you apply at a bank and borrow money and pay interest when you make payments.

The company says their credit builder loan helps diversify your credit profile. According to the site, “Having a mix of credit products brings on 10% of your credit score.” The company also says your “trade line,” which is another name for the credit builder loan, stays active on your credit profile for a decade.

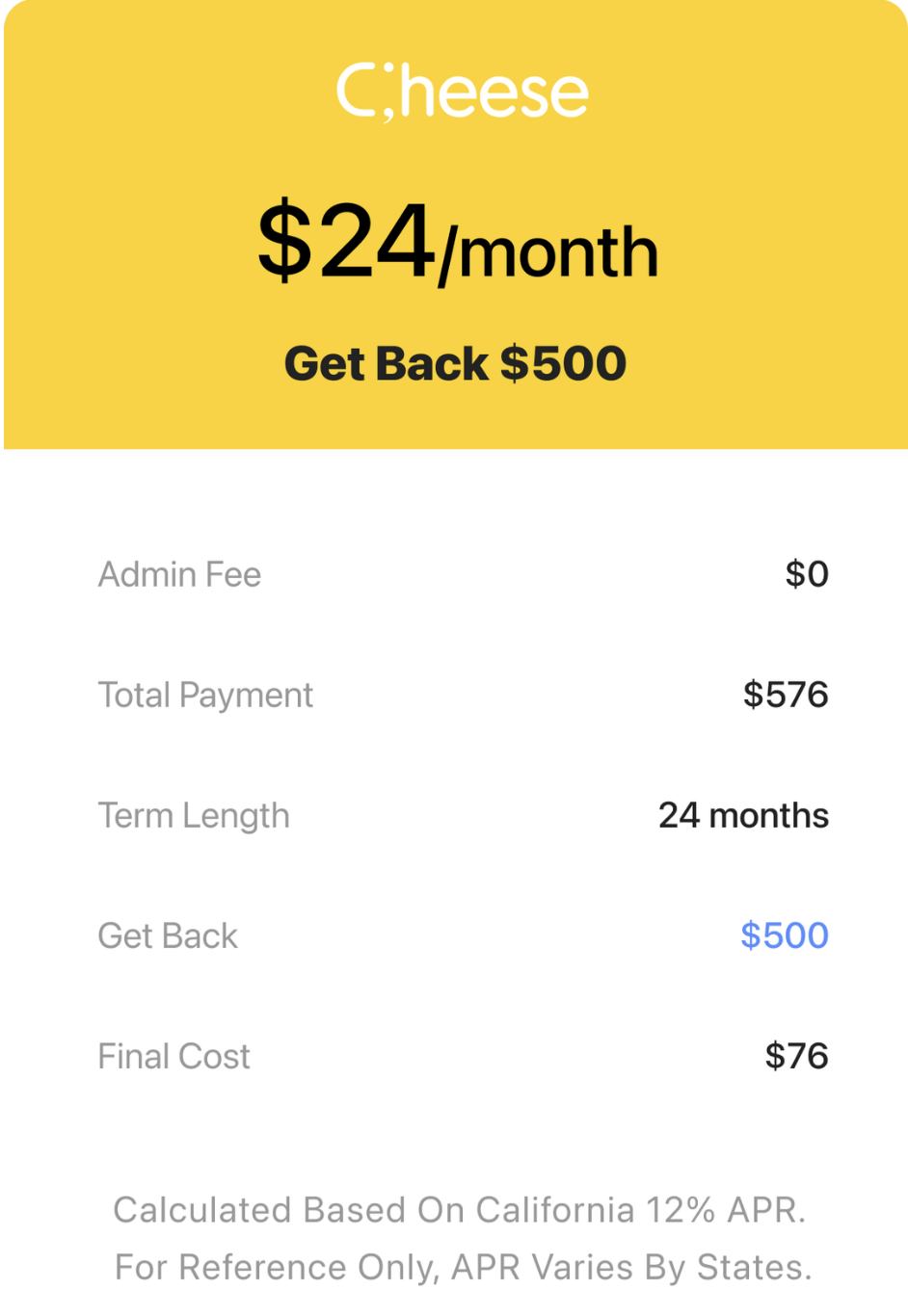

With a credit builder loan, the money you borrow isn’t available to you right away. It’s held in a savings account for a set amount of time, referred to as the loan term. Then, you choose how much you want to repay. For example, if money is tight, you can choose a repayment plan that starts as low as $24 a month.

Reports To All Three Bureaus

Just like you would with a traditional loan, you make on-time payments and Cheese will report these activities to all three credit bureaus, TransUnion, Equifax, and Experian. Making payments on time accounts for 35% of your credit score.

Automatic Payments

Conversely, missed payments and late payments will also be reported, which can negatively affect your credit and defeats the whole purpose of using Cheese. Cheese ensures you won’t miss a payment by allowing you to sign up for automatic payments.

Build Credit And Simultaneously Save

Then, when your term is over, you get the money in a lump sum, minus the interest you paid. With Cheese Credit Builder, you can build credit and save money at the same time.

There are no credit checks, administration fees, or subscription fees to pay. You can also cancel at any time without penalties.

How Much Does Cheese Cost?

There are no fees to pay, other than the interest.

The interest rate is determined by where you live, but they likely take your existing credit into account, as the rate fluctuates pretty widely—5% to 16%.

On their website, there is an image of an example loan from a borrower in California. That rate was at 12%.

Besides interest, there are no other fees or costs to worry about. They don’t even charge you a fee for late payments. They do this because they want credit builder loans to be accessible and affordable to anyone who needs to build credit.

How Does Cheese Compare?

If you’re curious about the credit builder loans from other companies, there are tons. They all offer similar services and products, but some, like Ava charges a subscription fee of $9. (Or $6 a month if you sign up for their yearly plan and pay in a lump sum.)

Ava has a credit builder card that you can sign up for and use to cover the cost of streaming services, such as Netflix or Spotify. You can do this directly from the app or website. The idea is, we all pay for streaming services, so might as well build credit each month by paying for it with their card. Ava reports to all three bureaus. If you’re not keen on paying interest with Cheese, Ava may be an option for you.

There’s also Self, which also has a Self Visa Card and a Credit Builder Account. Self is a similar to Cheese, but puts your money into an interest-bearing CD.

When you sign up, Self opens a CD in your name and you can pick one from $520 to $1,663. For 12 to 24 months, you pay level payments of $25 to $150 to the bank. Just like Cheese, you can build credit and save at the same time.

Once you've made at least three on-time monthly payments with and have at least $100 in savings, you can apply for the Self Visa secured credit card. The card comes with two major benefits—no credit check and you can add a credit card to your credit mix, which provides variety and can improve your score even further.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Interest Rate | 5% to 16% | None | APR: Up To 15.97% |

Monthly Fee | $0 | $9 | $25 to $150 |

Secured Card | |||

Cell |

These are more credit building opportunities reviewed by The College Investor:

How To Sign Up for Cheese

Cheese has both an iOS (over 1.7K downloads) and Android (over 50K downloads) app you can use on your phone. You sign up on your phone with your personal information including name, address, and Social Security. It will also ask for an email and a valid bank account in your name. You must have a valid bank account to sign up for Cheese.

Here are the best online banks to consider, if you need to take this step before signing up with Cheese.

Keep in mind that Cheese is available in 43 states. These are the states where Cheese is not available: AL, IN, KY, NV, VT, WA, and WI.

Then, you are instantly approved. After that, you can set your terms and how much you want to pay each month.

How To Contact Cheese

Cheese has a few ways to reach them, but none include a phone number. You can email their customer service team at support@earncheese.com.

You can also reach them through their website. They have a Zendesk option to ask questions directly. You can also read over their FAQ.

Their bank services are provided through our banking software provider, Synapse. If you have something bank or credit-related, call 844-525-6247 or email loans@synapsefi.com.

Is Cheese Safe To Use?

Cheese is safe to use on your mobile phone and they make sure every transaction is encrypted. In terms of your money, Cheese is FDIC-insured, which means up to $250,000 of your funds is protected. Cheese is FDIC insured with Lineage Bank.

Is Cheese Worth It?

Cheese is straightforward and doesn’t come with any fees besides interest. They also report to all three bureaus, which ensure you can build credit after making your monthly payments.

Using Cheese may also be worth it if you’ve had trouble saving money in the past. Because you make monthly payments and get to keep that lump sum at the end of the term, you can then use it to pay down high-interest credit card debt or throw it into your emergency fund.

Keep in mind that most credit building companies charge a fee, in one way or another, in the form of interest, like Cheese, or in a monthly subscription, like Ava. If building credit quickly is important to you, these fees will be money well spent.

How Important Is Credit To You?

Ask yourself this question before you start paying for a service like Cheese. If you have a lot of time to rebuild your credit before buying a house or car, for example, you can do it yourself by applying for a secured card like Grow Credit or Extra.

A secured card requires you to pay a deposit with your own money upfront, and then you can use the card to make purchases. When you make regular payments, your score will improve. Keep in mind there are also fees to use the card and interest rates as well.

The bottom line is time and money. How much of both do you want to spend on strengthening your credit? If it’s a priority, Cheese is absolutely worth it. If you’d rather not pay interest, you could opt for a subscription-based service like Ava.

Cheese Features

Loan Amounts | $500 to $2,000 |

APR | 5% to 16% |

Minimum Payment Due Each Month | $24 |

Terms | 12 or 24 months |

Administration Fees | $0 |

Credit Check Required | No |

Availability | Available in all states except:

|

Minimum Income Requirement | None |

Reports to Credit Bureaus | Yes, Experian, Equifax, and TransUnion |

Customer Service Email | support@earncheese.com |

Company Address | 130 W. Union St., Pasadena, CA 91103. |

Cheese Help Center | |

Banking-Related Customer Service Phone (Through Synapse) | 844-525-6247 |

Banking-Related Support Email (Through Synapse) | loans@synapsefi.com |

Other Helpful Cheese Links | |

Mobile App Availability | |

Promotions | None |

Build Your Credit With Cheese (Previously Cheese Banking)

-

Pricing and Fees

-

Customer Service

-

Ease of Use

-

Mobile App Availability

Overall

Summary

Credit building platform Cheese helps you establish credit automatically. See how they can help you if you have poor or no credit.

Pros

- Credit Builder Loan, their main product, is completely free of fees.

- Cheese is an FDIC-insured company.

- To apply, there are no credit checks that can temporarily hurt your credit.

Cons

- Even though there are no fees, you pay interest or an annual percentage rate (APR) which ranges from 5% to 16%.

- There are no other products to build credit, other than the credit building loan.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak