ProjectionLab is a financial modeling tool that helps you build financial plans.

At The College Investor, we advise readers to avoid student loans, pay off debt, grow their income (especially through side hustles), and build wealth through sound investment strategies.

We focus more on the tactical side of personal finance because every person needs to tailor their financial strategies through their own life stages and goals.

But if you’re serious about a specific financial goal, especially early retirement, educating yourself about techniques isn’t going to help you achieve your goal as quickly as possible. You need a plan and a way to assess whether that plan is going to work. ProjectionLab is a subscription service that could help you make and refine your early retirement plan. Here’s how it works.

Quick Summary

- Financial planning software for people seeking financial independence and retirement.

- Fully customized (including options to build in one-time expenses, alter income, plan taxes, reduce or increase spending, and more).

- Monte Carlo simulations to determine the likelihood of different outcomes associated with a given plan.

ProjectionLab Details | |

|---|---|

Product | Financial planning software |

Free Version? | Yes |

Pricing | $0-$540/year |

Financial Advice? | No |

Promotions | None |

What Is ProjectionLab?

ProjectionLab is a financial planning calculator that gives you the power to model your finances based on the life you want to live. It doesn’t dictate when you should want to retire, how much you should spend in retirement, how many kids you should have, whether to pay off your debt immediately or any other decision.

You bring your goals to the plan, and ProjectionLab shows you how those goals will affect your finances over time. And the forecasts ProjectionLab builds aren’t simplistic models that you could easily build in Excel. It uses a variety of robust assumptions (all of which you can configure) to give you a clear picture of what might happen in the future.

See where ProjectionLab lands on our list of the best retirement calculators here.

What Does It Offer?

ProjectionLab offers a financial planning calculator that gives you complete control of the inputs. Based on your goals, timelines, and assumptions, ProjectionLab creates compelling visualizations that show the likelihood of a plan succeeding over your lifetime, possible outcomes, and different ways to think through alternatives.

Here's some great scenarios to plan:

- Rent vs. Buy A Home

- How Different Home Prices (or other large purchases) Could Impact Your Goals

- Starting A Family

- Spending vs. Saving Extra Cashflow

Create Your Current Financial Snapshot

Unlike other financial planning tools, ProjectionLab doesn’t connect directly to your financial accounts. Instead, you can use the user interface to create your current financial snapshot. This includes details about your income, expenses, assets, and liabilities. You can also decide whether to look at a joint financial picture for married couples or to keep your finances separate.

Fully Customize Your Plan

The plans you build in ProjectionLab are fully customizable. You can add one-time expenses, alter expenses over your lifetime, change income projections, and even plan taxes. Each milestone you add is up to you. If you want to take a sabbatical at age 40 to visit all the National Parks, you can add that expense and the income gap to your plan. You can also quickly toggle add/hide certain scenarios to easily see their impact.

If you or your spouse plan to leave your job when you have children, you can build that into the plan too. Many rudimentary calculators assume that the life you’re living today will more or less be the same until you retire. But this calculator allows you to build nuanced plans.

Visualize Cash Flow

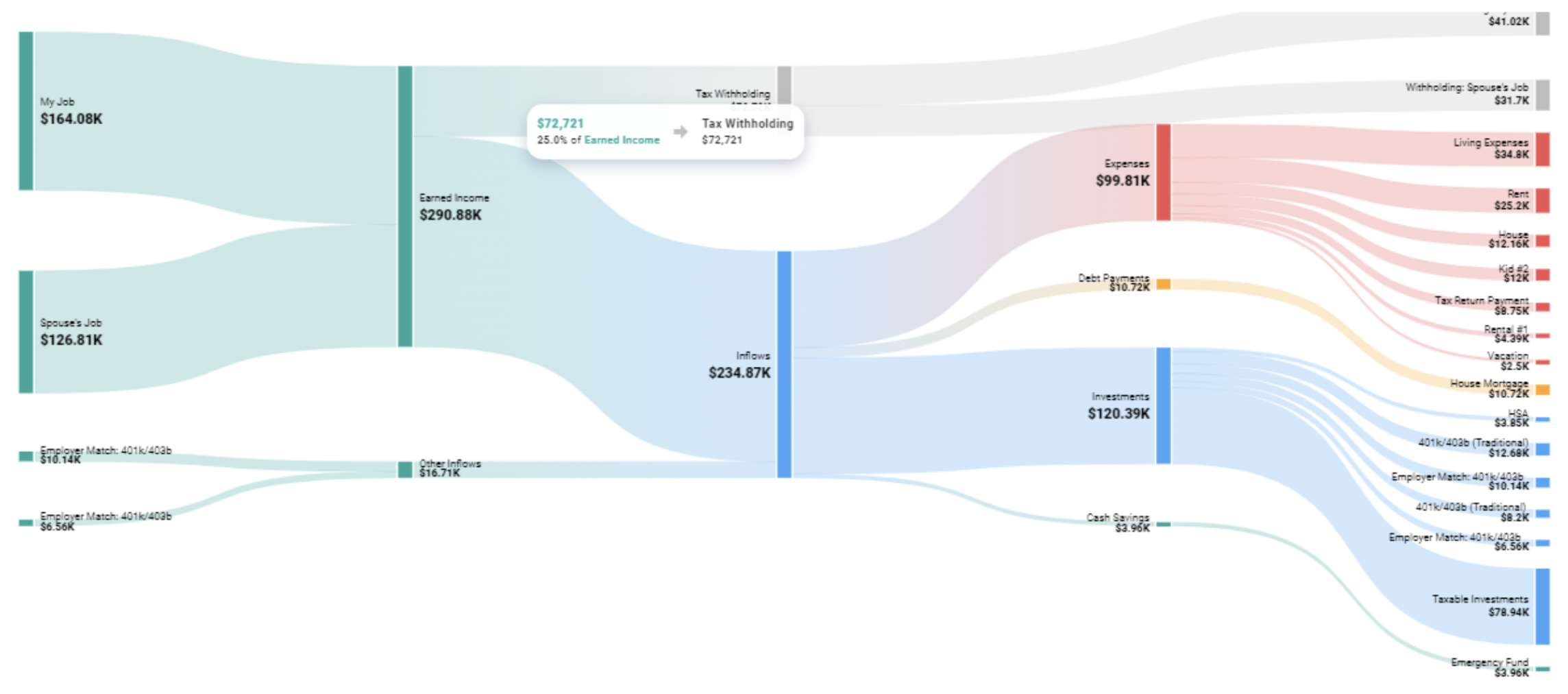

One of the most unique features of ProjectionLab is the forecasted cash flows. The tool uses a Sankey Chart to help you visualize money coming in and money going out. This is especially valuable if you have a big upcoming expense (like a remodel), or if you’re going to pay for a recurring expense for several years (such as paying for daycare for a child).

Likelihood of Success

While your initial plan might look like your dream life, ProjectionLab allows you to run simulations to see if that dream is realistic. The tool allows you to run Monte Carlo simulations (which is a form of probability modeling) to see whether you’re likely to run out of money in the short term, over decades, or over your entire lifetime (based on your retirement date and life expectancy).

When you use probability to test a plan, you can gain insights into the strengths and weaknesses of your plan. This is much better than relying on Average Net Worth figures and retirement planning rules of thumb.

Tax Analysis and Estimation

Whether you’re in your high-earning years or your retirement spending years, taxes can be one of your largest expenses. ProjectionLab offers Premium users (those who pay for an upgrade) access to tax analysis (how to be more tax efficient) and tax estimation (what future taxes might look like) to assist with nuanced planning.

Are There Any Fees?

You can use the Free version of ProjectionLab for “ad-hoc” planning. You can also test the Premium and Pro versions of the tool for 7-days before committing to the paid product.

Most people who opt for the paid product will opt for the Premium tool. The Pro pricing tier is intended for financial advisors who need to store client information. The Premium tool has annual, monthly, and lifetime subscriptions available.

Free | Premium | Pro | |

|---|---|---|---|

Cost |

|

|

|

Best For | People seeking a one-time plan | Individuals looking for robust planning tools | Financial advisors who want to store plans for multiple clients |

Features |

|

|

|

How Does ProjectionLab Compare?

ProjectionLab is a unique tool because it's a financial planning tool for people who aren’t financial planners. It’s not a portfolio analysis tool (like Vyzer or Snowball Analytics). And it doesn’t offer services from a CFP like Facet Wealth or Wealthfront. It's a planning tool, and it is one of the most robust tools on the market, especially for people who don’t have a financial planning background. The best comparisons would be other retirement calculators, such as OnTrajectory or FI Calc, which is a free tool that lacks the functionality of ProjectionLab.

In general, it is a great tool for helping you gain confidence in the steps you’re taking to build financial freedom into your life. Even if you use the tool, it may still make sense to connect with a fiduciary financial advisor before making major financial moves. Having a professional second opinion can help you decide whether you’ve overlooked anything important.

Header |  |  | |

|---|---|---|---|

Rating | Not Yet Rated | Not Yet Rated | |

Pricing | $0-$540/year; lifetime subscription available | $0-$80/year | Free (Donations Accepted) |

Advisor Accounts | |||

Financial Advice | |||

Cell |

How Do I Open A ProjectionLab Account?

You can use the ProjectionLab “Sandbox” for free without creating a ProjectionLab account. If you want to upgrade to a Premium or Pro account, you'll need to provide your email address, which entitles you to a 7-day free trial.

To continue using the account, you’ll need to begin payment which requires you to enter your name, billing address, credit card number, and other basic payment information.

Is It Safe And Secure?

ProjectionLab doesn’t hold any of your personal information, and it doesn’t connect to any of your bank accounts. Because of this, your risk of losing private information is very low.

Paying customers who want to “persist” data from session to session can choose whether to use secure cloud storage or to self-host their information. Either one of these methods is quite secure, but if you opt for cloud storage, your information could be stolen in the event of a hack. That said, the information isn’t tied to you, so the risk associated with that information being stolen is low.

ProjectionLab doesn’t sell your information, and there are no ads on the platform, but it does collect and store the name, email address, and credit card information of Premium and Pro users via their processor Paddle.

How Do I Contact ProjectionLab?

Discord is the most popular way to contact the team. The ProjectionLab team and developer, as well as an engaged community following, are all on Discord.

ProjectionLab is currently a one-developer shop, but it has a customer support email address support@projectionlab.com. Customers who pay for Premium or Pro service are guaranteed to have Developer Support.

Is It Worth It?

If you have an hour or two to dedicate to learning the tool, ProjectionLab Free is an incredible resource. It’s one of the few tools that allows you to think through what you really want and decide whether the tradeoffs between “current” you and “future” you are worthwhile. Most people aren’t going to be dedicated enough to update their financial plans regularly, so a one-time look will be adequate.

For comparison, meeting with a financial advisor will run between $200-$400/hr, so the annual plan is generally a good value for DIY planners or those just looking to streamline a meeting with advisor.

If you’re invested in an early retirement, or you’re serious about a life-interrupting event (like extended world travel), paying for the Premium version may be worthwhile. You are more likely to want to tinker with your plan and keep it updated based on your current financial situation.

Financial advisors and financial coaches may have the most to gain from ProjectionLab. It comes at a modest cost, and it allows you to forecast scenarios in a way that is easy for most clients to understand.

ProjectionLab Features

Product | Financial planning calculators |

Free Version | Yes |

Service Plans |

|

Free Trial | 7-Days |

Monte Carlo Simulations | Yes |

Sankey Diagrams | Yes |

Tax Analysis | Yes |

Customer Service Email | support@projectionlab.com |

Discord Community | https://discord.gg/dZQ5DDEmT7 |

Mobile App Availability | No |

Web/Desktop Account Access | Yes |

Promotions | None |

ProjectionLab Review

-

Fees and Pricing

-

Products and Tools

-

Ease of Use

-

Customer Service

Overall

Summary

ProjectionLab is a freemium financial planning calculator that helps individuals and financial advisors simulate various future financial scenarios.

Pros

- You can completely customize your plan based on your goals.

- Uses statistical methods rather than assumption-based projections.

- Includes tax analysis tools.

Cons

- Cannot directly connect to accounts for live tracking.

- Can take a bit of time to get to understand the software.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Colin Graves Reviewed by: Robert Farrington