If you need to file a tax extension, here's how you can do it with the tax software you normally use. Remember, you can get a 6-month extension to file your taxes, but there is a catch!

The official tax filing deadline is April 15, 2024. But getting your taxes done on time may be leaving you completely stressed and overwhelmed.

Whether you still need to get your finances in order or your plan to file on time has been sidetracked by unforeseen circumstances, you can request a six-month filing extension from the IRS.

Here’s how to get an extension on your taxes for the 2023 tax year (which you're filing in 2024).

Do You Actually Need To File A Tax Extension?

First, do you even need to file a tax extension? Maybe...

If you are getting a tax refund (make sure you're certain), you actually don't need to file an official extension. You can file your taxes anytime up to three years from now to claim your tax refund. However, if you miss the three year window, you're out of luck.

Second, some places may automatically get an extension due to various issues. In 2024, there are a few areas that are automatically getting an extension. You can see the IRS list here. These areas include:

- Certain areas in Maine have until July 15

- Certain areas in Rhode Island have until July 15

- Certain areas in Alaska have until July 15

- Certain areas in Southern California have until June 17

- Certain areas in Michigan have until June 17

If neither of these apply to you (i.e. you owe taxes), then you need to file for a tax extension.

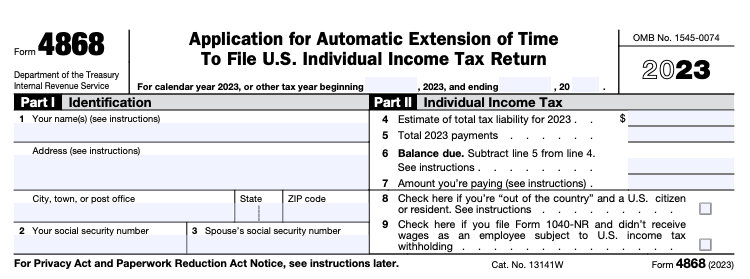

You Need To Fill Out A Federal Extension Form 4868

To move your tax filing due date to Oct. 15, 2024 you need to complete IRS Form 4868. The form needs to be completed on or before the April 15, 2024 tax deadline. Keep in mind that you must still pay what is owed to the IRS by this April deadline. An extension does not mean you can also delay what needs to be paid.

You need to submit Form 4868 to avoid failure-to-file penalties that can add up to 25% to your tax bill.

When you file a tax extension you receive an extra six-months to file your Federal Taxes. This is an extension to file your return, not an extension to pay your taxes.

You can fill out a paper form and mail it to the appropriate IRS location (which varies by state) or e-file it using the IRS online fillable forms or tax software like TurboTax, FreeTaxUSA, TaxAct, TaxSlayer, or H&R Block.

Here are the links that go directly to the extension pages of popular tax software:

The form, pictured above, is deceptively complex. With just nine fields, it looks like it should take mere minutes to complete. You start by filling out your name, address, and Social Security Number.

Then you get to field 4, which requires you to estimate your total tax liability for 2023. Most people who know their tax burden don't need to file an extension.

Estimating your tax burden is the most difficult part of filing an extension. If you're looking for guidance on how to estimate your tax burden, you won’t find it with the IRS, which tells filers to “properly estimate your tax burden using the information available to you.”

When you estimate your tax burden, you want to be as accurate as possible. Certain tax software companies that allow you to e-file an extension have built-in calculators to help you estimate your taxes.

Tax Tip: The TurboTax Calculator is an especially helpful tool that will work for most filers seeking an extension.

If you're really struggling with estimating your income, you may want to spend a couple of hours using the best tax software to get a more thorough estimate of your business or rental income.

The remaining fields include a total of 2023 Federal Tax Payments, the balance due (if you owe more taxes), and the amount you’re paying at the time of filing an extension.

File A Tax Extension For Your State

If you live in a state that requires a state income tax, you may need to file an extension in your state. The process for requesting an extension varies by state. Some states automatically grant a six to seven month extension when the IRS grants one to you.

Other states require you to request an extension using their process. When you use tax software to request a Federal extension, you will see the option to request a state extension as well.

If you’re not using tax software, you can also use an online search to figure out the process for requesting an extension in your state.

You Still Have To Pay Your Taxes By April 15

The extension to file is not an extension to pay your taxes. You should pay unpaid taxes at the time you request an extension. If you can’t pay the amount in full, pay as much as you can. Filing a tax extension doesn’t absolve you from paying your taxes on time and in full.

The interest rates for overdue taxes range from 5% to 8% for 2023. If you have the cash to pay off back taxes, take care of the debt right away. This way you can avoid paying even more in interest over time.

If you dramatically underpaid your taxes (less than 90% of what you actually owed), you may owe a tax penalty which can range from 5% to 25% of your unpaid tax burden.

Make sure to prioritize paying your taxes before April 15, even if you can’t complete your filing by the original tax deadline.

Don’t Expect A Refund Until You’ve Filed

If you overpaid your taxes for 2023, you will be paid a refund. But that refund won’t come just because you filed Form 4868.

You won’t see a refund check until you complete your real tax return. You can expect to see a small amount of interest on the cash the IRS holds for you, but make sure you put your tax refund to work once you get your money back from the IRS.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Ashley Barnett Reviewed by: Robert Farrington