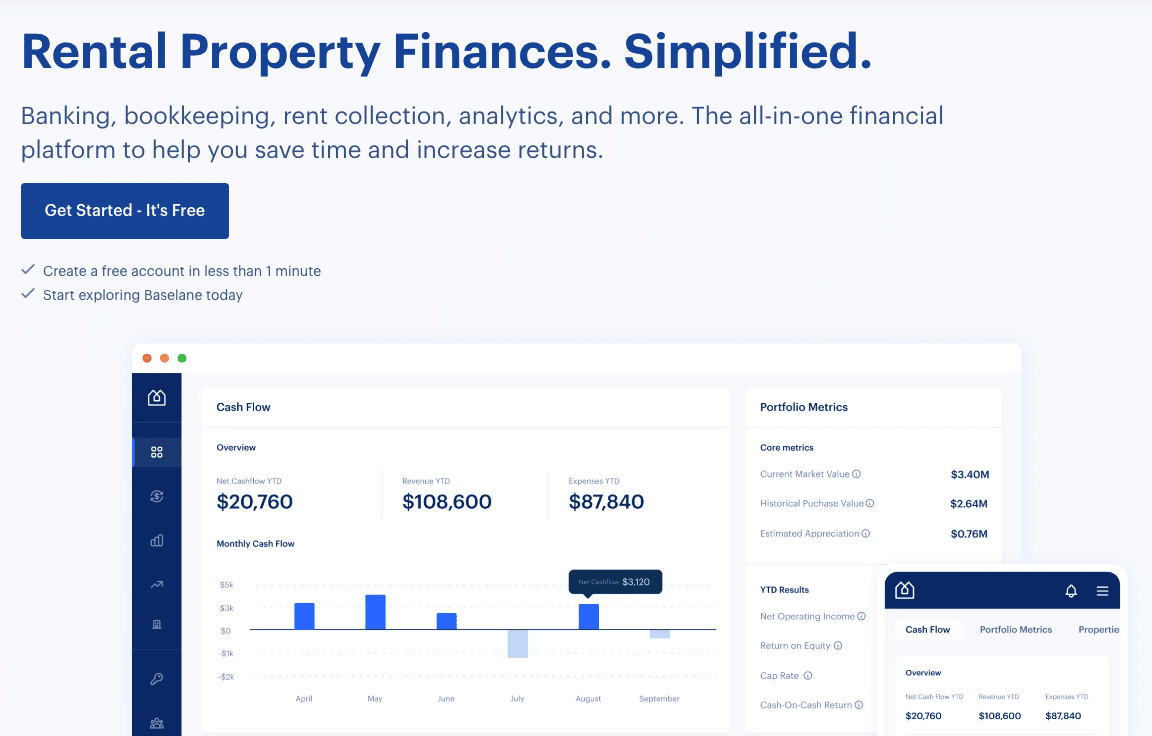

Baselane provides banking and other financial services for landlords.

If you’re an independent landlord, it probably doesn’t make sense to hire bookkeepers and pay for dozens of software subscriptions. You may manage your real estate financials in Google Spreadsheets or use other free tools. However, using spreadsheets is very much a manual process, which means it can be time consuming and a hassle. Perhaps you’ve reached the point of wanting a more automated process for managing your real estate so you can free up that time to vet new tenants or look for new properties. This is where Baselane may help.

Baselane is an all-in-one financial system that includes half a dozen tools to manage and grow your investment portfolios. If you’re thinking about investing in real estate, or struggling to manage your rental portfolio, Baselane may be a good fit for you.

Bonus: Right now, Baselane is offering a $150 bonus for new users!

Baselane Details | |

|---|---|

Product Name | Baselane |

Min Balance Requirement | None |

Monthly Fee | None |

Earns Interest | Earns up to 4.19% |

Cash Back | Up to 5% |

Promotions | Up to $300 |

What Is Baselane?

Baselane is a fully integrated financial solution designed specifically for landlords. Founded in 2020, it offers free products including:

- Bookkeeping apps

- Rental collection options

- Free business checking and banking

It also provides paid products including loans for landlords and landlord insurance that are integrated into the platform for your convenience.

The company currently serves thousands of landlords across all 50 states in the U.S. Baselane’s partnership with Blue Ridge Bank, N.A. and Thread Bank, Members FDIC, allows the company to offer a full range of financial products.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Baselane is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

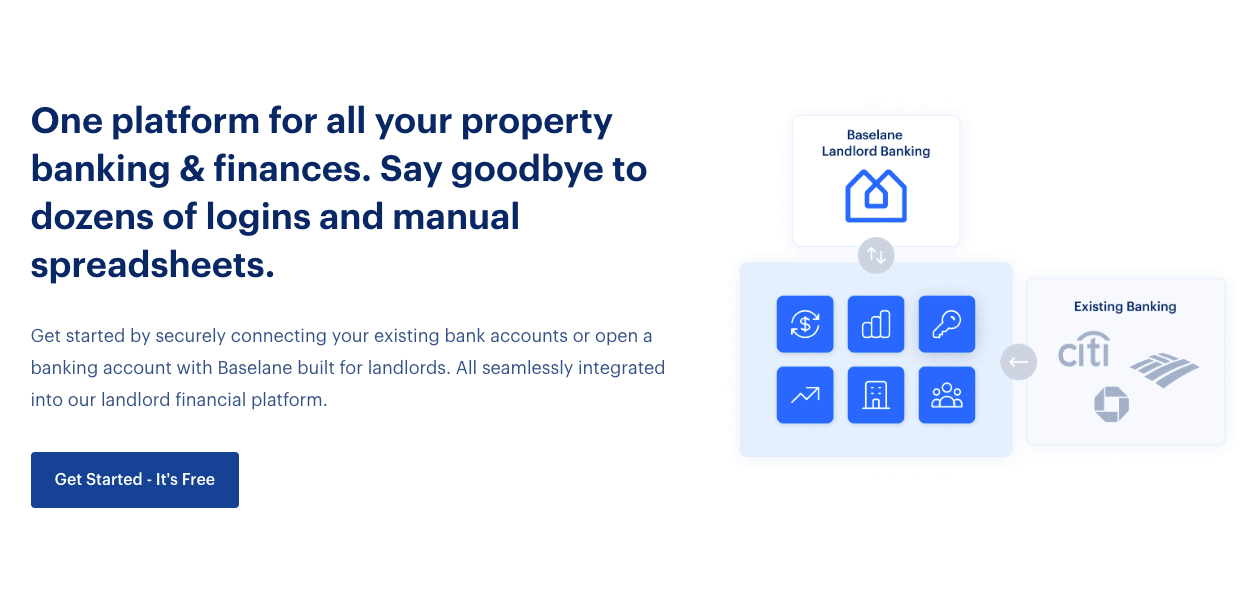

As a digital company, Baselane addresses the banking and financial needs of independent landlords. Its various features are useful when used individually, but are designed to work together as an integrated financial solution.

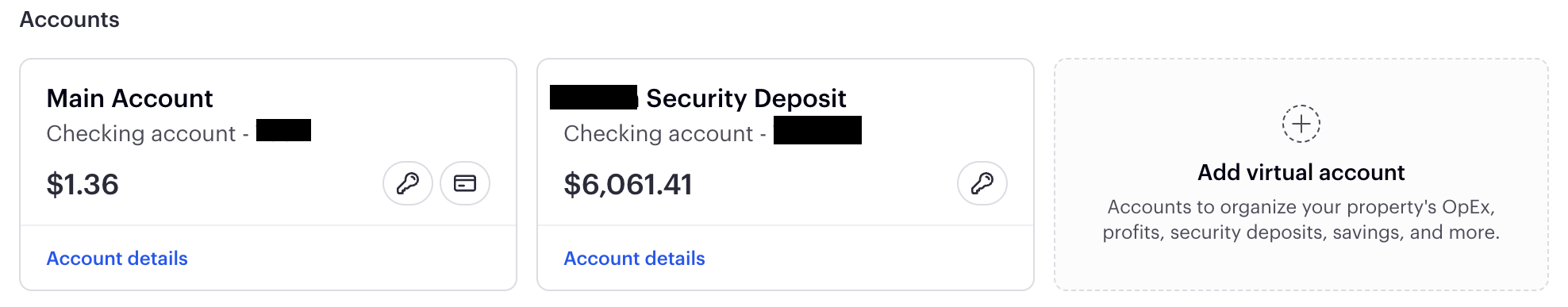

Free Business Checking for Landlords

Baselane’s business checking account is a free checking account designed for landlords. The account has “virtual accounts” that allow you to subdivide income and expenses by property, track security deposits, and tailor the way you manage your money. Landlords can make payments via ACH, deposit cash via an ATM, or deposit checks using the Baselane mobile website (not an app). The account also has a debit card with 5% cash back.

Baselane recently added checkwriting as well.

We’ve always recommended that side hustlers should keep personal checking and business checking separate. If you’re a real estate investor, consider doing the same. Baselane’s free checking account makes it easy.

Unlimited Savings Accounts And Buckets

Beyond the free checking accounts, you can have unlimited savings accounts as well. This is great for making "buckets" - like security deposits, sinking funds, and more.

Baselane offers a competitive interest rate of up to 4.19% APY. See how it compares to other real estate banking accounts. You must have your money in a savings account to earn.

Savings account rates are tiered, and if you use Baselane's rent collection tool, you get a higher tier APY.

Balance | APY |

|---|---|

$0 - $9,999 | 1.95% |

$0 - $9,999 + Rent Collection | 2.41% |

$10,000 - $24,999 | 2.93% |

$10,000 - $24,999 + Rent Collection | 3.40% |

$25,000 - $49,999 | 3.40% |

$25,000 - $49,999 + Rent Collection | 3.87% |

$50,000+ | 4.19% |

Here's what the setup looks like:

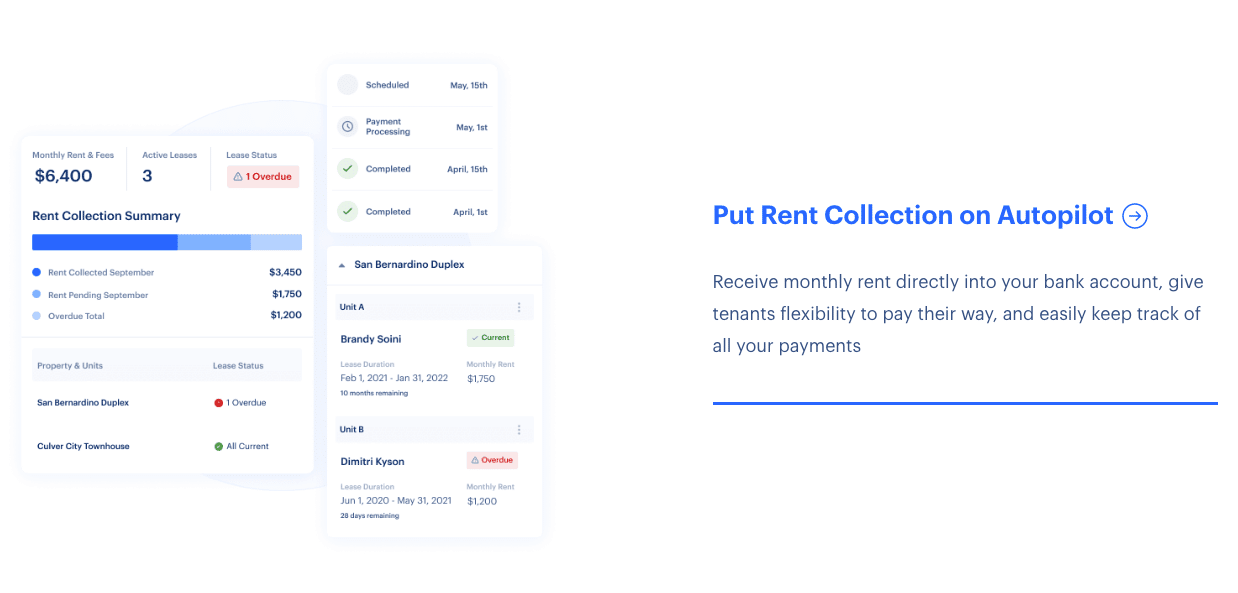

Online Rent Collection

As a landlord myself, I’ve dealt with having to collect rent. Over the years, I've knocked on doors and collected cash, deposited cashier's checks, and received rent online.

Baselane is one of the few companies that make online rent collection easy and secure. Baselane's Rent collection is free, and landlords can have the rent deposited to any account (including an account held outside of Baselane).

Baselane also has mobile check deposit (Note: it's through the mobile browser, not an app).

This functionality mirrors a functionality offered by Apartments.com for landlords who use that platform.

Free Bookkeeping App For Landlords

If you’re not eager to switch bank accounts but want to try Baselane, consider starting with their bookkeeping app—which is a game changer. Plus, it’s free. The app allows you to track and categorize expenses and generate a free Schedule E at tax time.

The only downside to this app is that it doesn’t auto-import a full account history for certain account types. It may be ideal to start relying on this in December or January, so you can track a full year.

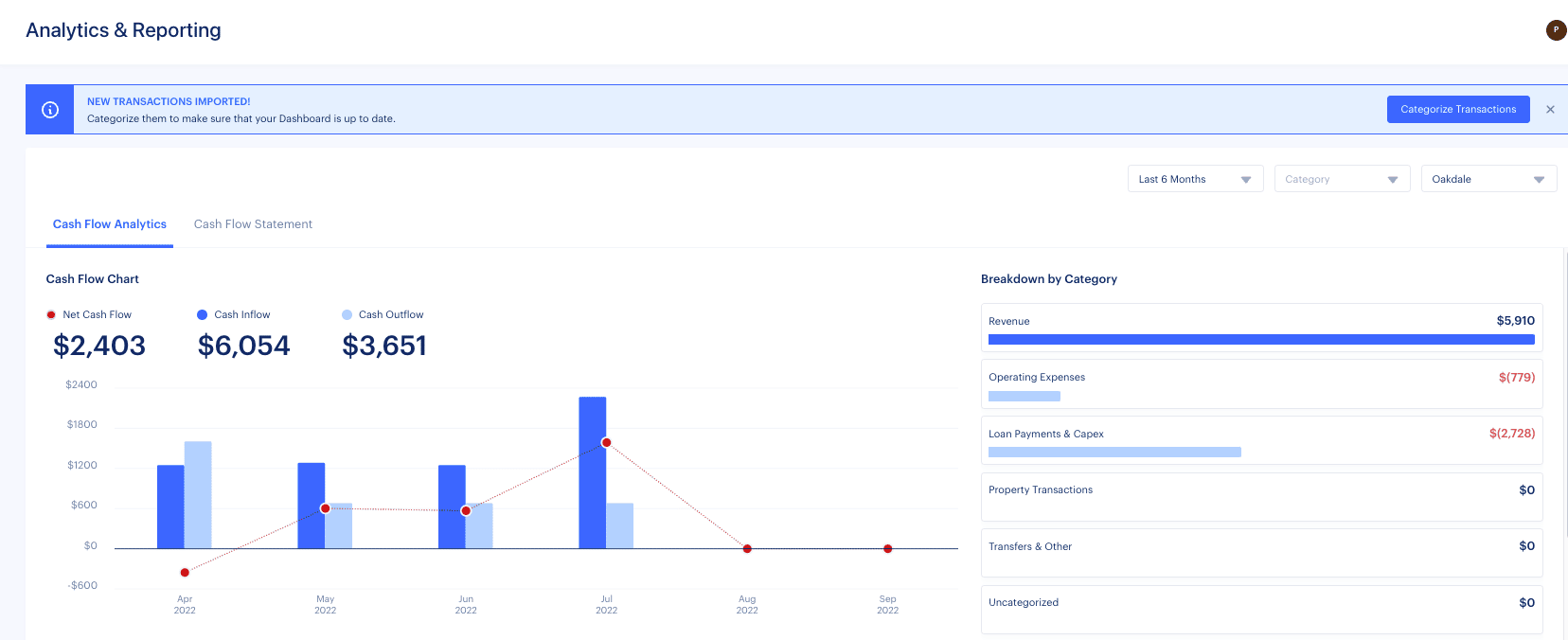

Cash Flow Statement

Landlords can also take advantage of Baselane's Cash Flow Statement, which is also exportable. The statement includes:

- Revenue

- Operating expenses

- Net operating income

- Net cash flow

Baselane plans to add the Income statement and Schedule E report in the future.

Loans Designed For Landlords

Baselane’s marketplace offers real estate investment loans through a partnership with private lender, Lendency. This loan can be useful to buy, refinance, or rehab an investment property. The company issues loans based on your real estate portfolio rather than your W-2 income.

Dashboards Showing Rental Performance

Stock and crypto investors can choose from half a dozen or more investment apps that track their portfolio’s performance daily. If you’re a rental property investor, your investment tracking options aren’t as robust.

Baselane offers detailed insights into cash flow and property valuations. The company also plans to add metrics including cash on cash return and other landlord-specific metrics.

Are There Any Fees?

Baselane’s checking, rent collection, and analytics features are free.

However, for any loans you take out through Baselane's partner Lendency, you’ll pay interest and fees. The terms and conditions are laid out in the loan documents, but you may want to shop around before committing to any loan.

Likewise, you have to pay premiums for insurance products purchased through Baselane's partner Obie.

How Do I Contact Baselane?

Baselane has a chat feature on its website, but prospective customers can also email support@baselane.com to reach customer service. The customer service number is 888-586-1618.

The company is headquartered at 280 Park Ave., New York City, New York 10017.

How Does Baselane Compare?

Baselane is in a class by itself when it comes to integrated financial solutions for independent landlords. It offers free bookkeeping software tailored to landlords. You could use alternatives like QuickBooks, but Baselane’s software makes more sense for landlords, with expense categories that line up with Schedule E categories required for tax filing.

It offers rent collection and analytics like Apartments.com. But Baselane’s reports and insights feel more user-friendly and are easier to understand.

Finally, Baselane offers free business checking, similar to Stessa. But Baseland is more robust, due to functionalities like mobile check deposit and integrated bookkeeping.

Header |  | ||

|---|---|---|---|

Rating | |||

Monthly Fee | $0 | $0 | $0 |

Online Deposits | Yes | Yes | Yes |

Cash-Back Debit | Yes | No | No |

Fee-Free ATMs | Yes, 55,000 | 50,000 ATMs | Yes, via Refund |

Cell |

The Baselane platform is intuitive and inexpensive that any real estate investor can benefit from using it. Even established real estate investors may want to consider slowly switching over to the Baselane ecosystem.

How Do I Open An Account?

If you’re interested in the free bookkeeping app, you can sign up with an email address, a phone number, and a password. Once you’re registered, you can connect your bank accounts (through a service called Plaid) to start using the bookkeeping software.

To start receiving rent through Baselane, you need to provide your tenant contact information as well as account details for where Baselane will deposit rental income.

Opening a checking account or taking out a loan also requires providing personal information. Loans may require documents and verifications such as proof of ownership, property valuations, or income statements.

Is It Safe And Secure?

Baselane uses multiple layers of security to keep your money, identity, and personal information safe. The company uses end-to-end encryption, and it tokenizes (or encrypts) personal data to keep users safe. The bookkeeping app relies on read-only account information, so hackers can’t steal your money via the Baselane app.

Baselane’s checking account is issued through an FDIC-insured bank, and the loans are issued through a legitimate financial institution. Given the above-average security on the Baselane website, anyone who uses an online bank should feel comfortable banking through Baselane.

However, Baselane’s website collects a lot of personal information about users, and like anything online, this information could fall into the wrong hands (despite the encryption and tokenization). If you’re nervous about cloud-based accounting services, Baselane may not be the right product for you.

Who is This For And Is It Worth It?

Overall, Baselane has succeeded in creating an integrated financial solution for landlords. It's clear that the company understands and addresses ongoing pain points for independent landlords.

If you’re about to start investing in real estate, you should consider Baselane’s full suite of solutions. This may include researching insurance and loans as well as shopping for mortgages.

Baselane may also make sense for established landlords who want better solutions for managing their finances. At a minimum, Baselane’s free bookkeeping option is a must if you want to make tax time easier. The checking and rent collection options are also great to integrate as you get new renters into your properties.

Baselane Features

Account Types |

|

Minimum Initial Load | $0 |

Cash Back | 1% with their debit card |

Earns Interest | Up to 5% with their debit card |

APY | 4.19% |

Branches | None (online-only bank) |

ATM Availability | Fee-free for over 55,000 ATM locations |

Customer Service Number | 888-586-1618 |

Customer Service Hours | Mon-Fri 9 a.m.-5 p.m. EST |

Customer Service Email | support@baselane.com |

Mobile App Availability | None |

Web/Desktop Account Access | Yes |

Direct Deposit | Yes |

Bill Pay | No |

FDIC Certificate | 35274 (through Blue Ridge Bank, N.A.) |

Promotions | Collect rent, earn $150 bonus |

Baselane Review: Banking For Landlords

-

Fees and Charges

-

Customer Service

-

Tools and Resources

-

Products and Services

-

Ease of Use

Overall

Summary

Baselane is a financial system that includes half a dozen tools to manage and grow investment portfolios for independent landlords.

Pros

- Free checking, bookkeeping, rent collection, and performance analytics

- Bookkeeping app uses third-party integrations to keep your money safe

- Loans and insurance tailored to landlords

- Unlimited savings accounts

Cons

- Works better when all of your landlord finances are done through Baselane.

- You may have to get renters signed up on a new payment platform.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington